Winner: Venmo – the next generation checking account

Venmo, the PayPal-owned peer-to-peer payments app, is one of the best-known and largest disruptive fintech companies.

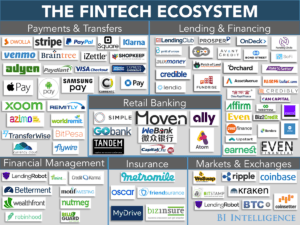

Organizations in consumer financial services ranked third in being the most disrupted industry by digital; 61% of the surveyed C-level executives responded that their business would be moderately or massively disrupted in the next 12 months.[i] Almost every kind of financial activity — from payments to retail banking to wealth management — is being re-imagined by startups (see figure 1), some of which have garnered large investments.[ii] Worldwide investments in startups focused on retail banking markets rose to nearly $6.8 billion in 2015, more than triple the $2.2 billion in 2014.[iii] Meanwhile, incumbent banks are trying to follow suit with new products and find a way to develop new platforms while overcoming legacy infrastructure.[iv]

Venmo, the PayPal-owned peer-to-peer payments app, is one of the best-known and largest disruptive fintech companies. It allows registered users to transfer money between one another through a “digital wallet” using a mobile phone app or web interface, and integrates seamlessly with bank accounts and credit/debit cards. Users have a Venmo balance that is used for their transactions; only if the balance is insufficient, Venmo automatically withdraws the funds from the registered bank account or card.[v]

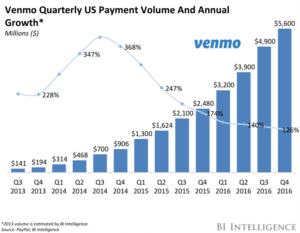

The open platform processed $17.6 billion overall in the past year (see figure 2). Q4 2016 marked the product’s 14th consecutive quarter of more than 100% growth, and the platform hit both the $1 billion and $2 billion monthly milestones in 2016.[vi] Furthermore, Venmo’s brand value and recognition is very high – the app became even a verb (“Just Venmo me”).[vii]

Venmo’s transaction volume is even more impressive considering that currently just 25% of US adults used their mobile devices to send money to relatives and friends. However, the number is likely to keep increasing: Venmo is beginning to cross generations, as younger adults persuade their parents to use the smartphone app for sending money and splitting payments.[viii]

In contrast to Apple Pay and PayPal itself, the “digital wallet” can be shared over a social network. Mimicking a social media feed, transaction details (without the payment amount) can be shared on the user’s news feed and to the user’s network of friends. Furthermore, its security is bank-grade; personal and financial data are encrypted and protected on secure servers to guard against any unauthorized transactions. Thus, paying with Venmo is considered safe, easy, fast, and entertaining – especially among Millennials.[ix], [x]

While banks make much of their revenue these days from fees charged on various kinds of transactions, Venmo payments with a bank account or debit card are fee-free (credit cards have a 3% fee for each transaction). But since the app itself and the majority of consumer transactions are free, it isn’t a profit-generator for PayPal. However, it helped Venmo attracting many users and allows collecting a lot of real world data about payment processing, giving PayPal an edge over Apple.[xi] Going forward, PayPal has several options to monetize Venmo better: It could demand a fee for bank account and debit card transactions, which risks the alienation of (potential) customers. Alternatively, it could invest the money in the Venmo balance, which is challenging from a regulatory viewpoint, requires new investment skills, and is risky in a low-interest environment. Last but not least, Venmo could expand their new feature “Pay with Venmo”, thereby monetizing merchants: With “Pay with Venmo”, users are able to select Venmo as a payment option when purchasing on one of eleven partner apps, which include Boxed, delivery.com, and Munchery. For users “Pay With Venmo” is free, but merchants pay a per transaction fee of 2.9% plus $0.30. It is expected that Venmo expands the program, allowing Venmo also to recruit a new customer base through merchant relationships and increasing customer loyalty by providing more and tighter ways for users to interact with Venmo.[xii]

[i] Rhys Grossman (Mar 21, 2016). The Industries That Are Being Disrupted the Most by Digital. Harvard Business Review. https://hbr.org/2016/03/the-industries-that-are-being-disrupted-the-most-by-digital

[ii] Evan Bakker (Feb 22, 2016). Technology is disrupting the financial services industry — here’s how. Business Insider. http://www.businessinsider.com/technology-is-changing-the-financial-services-industry-2016-1

[iii] Steve Lohr (Jan 18, 2016). As More Pay by Smartphone, Banks Scramble to Keep Up. New York Times. https://www.nytimes.com/2016/01/19/technology/upstarts-are-leading-the-fintech-movement-and-banks-take-heed.html?_r=0

[iv] Ibid. http://www.businessinsider.com/technology-is-changing-the-financial-services-industry-2016-1

[v] Daniel Newill (Nov 39, 2014). Is PayPal’s Venmo the Bank Killer App? http://marketmadhouse.com/is-paypals-venmo-the-bank-killer-app/

[vi] BI Intelligence (Jan 31, 2017). Venmo’s monetization will be worth watching. Business Insider. http://www.businessinsider.com/venmos-monetization-will-be-worth-watching-2017-1

[vii] Felix Gillette (Nov 21, 2014). Cash is for Losers! Bloomberg. https://www.bloomberg.com/news/articles/2014-11-20/mobile-payment-startup-venmo-is-killing-cash

[viii] Steve Lohr (Jan 18, 2016). As More Pay by Smartphone, Banks Scramble to Keep Up. New York Times. https://www.nytimes.com/2016/01/19/technology/upstarts-are-leading-the-fintech-movement-and-banks-take-heed.html?_r=0

[ix] Neelesh Moorthy (Mar 26, 2015). Cash, credit or mobile app: the rise of Venmo. The Chronicle. http://www.dukechronicle.com/article/2015/03/cash-credit-or-mobile-app-rise-venmo#.VTIK-eGzn6o

[x] Fiscal Today (Mar 11, 2015). Venmo: App to make and share payments. http://fiscaltoday.com/venmo-app-make-share-payments/

[xi] Ibid. http://marketmadhouse.com/is-paypals-venmo-the-bank-killer-app/

[xii] BI Intelligence (Jul 27, 2016). Venmo’s latest feature is now available to all users. http://www.businessinsider.com/venmos-latest-feature-is-now-available-to-all-users-2016-7

Definitely struggle with how Venmo captures value. Would it have survived as a standalone company long term if it hadn’t been acquired? If I were a merchant, I’d be curious to know how I could extract value from data in Venmo’s social feed, ie which users who are always splitting late night pizza bills. Maybe they’ll one day introduce better tagging in the feed to facilitate another monetization stream.

Hey, thanks for your answer! I like your idea of providing data analytics to merchants using the social media feed – that’s definitely a potential additional revenue stream!

Yes, I think Venmo would have survived even as a standalone company. Sure, that’s a mere assumption and I can’t prove the counterfactual of the acquisition by PayPal, but Amazon was unprofitable 1995-2002, 2012 and 2014, and still attracted masses of investors because their expenses were seen as investments in LT growth. Twitter has burned $2bn since launching a decade ago, and investors’ pressure today seems to have less to do with anxiety whether or not the company can earn money now and more with its prospects to grow its user base continuously in the future. I think Venmo’s growth rates would enable them to raise sufficient funding as an independent company.

Hi Carolin,

It’s interesting to see that you covered Venmo, since I use the app myself and it’s extremely convenient. I covered Paytm which is also a digital wallet in India. This is certainly an exciting space for the financial services industry. However, my concern with Venmo is that I do not see a robust revenue model in place unless it scales the Pay with Venmo option and ties up with various vendors. In a market like U.S. where debit c card payments are easily acceptable with every vendor, I do not know if Venmo can actually cause disruption in this space. Would be interesting to see them evolve their model further.

Hi Charu,

It was great hearing about Paytm and how they managed to grow from a prepaid mobile recharge website to a payment and commerce ecosystem. I agree – in my opinion Venmo’s best monetization strategy is to breach out and scales “Pay with Venmo”. However, I think that mobile payments could disrupt debit/credit card payments in stores because it’s more convenient than cramming for your card and often having to sign or type in a number

Great post on a very interesting business.

When I started using Venmo, I immediately assumed they were essentially acting as a bank, investing or loaning out large portions of the balance and using it as a means of creating additional value and capturing it, but later learned that, as you mentioned, they do not, seemingly due to the complicated regulatory aspects (becoming a bank…). That said, I do wonder what cash balance they actually hold.

Even in this day and age when information is being monetized frequently and repeatedly, I am still having a hard time seeing the immediate value created by the text collected and processed by Venmo. So that would leave us with “Pay w/ Venmo” and the challenges it entails. In a world of growing saturation in the payment instruments, I will be looking forward what waves they can generate.

Hey,

Glad that you liked my post, thank you!

I personally think the social feed is fun – people get really creative describing what the purpose of payment was for. Furthermore, the large user base especially among millennials gives Venmo a HUGE competitive advantage in direct peer-to-peer payments; it’s would be very difficult for a potential competitor to threaten Venmo’s positioning in that space, I think. Thus, while I agree with you that Venmo should expand “Pay with Venmo”, I think that it’s not their only option and they could also monetize its peer-to-peer business more by carefully charging credit card payments, data analytics and maybe even introducing some advertising.

It will be very interesting to see what route Venmo is taking!

PS: I don’t know if you read the other comment, which I found also interesting: it suggested to use the social feed for data analytics for merchants, potentially tapping an additional revenue stream.

Thanks for a nice post with great points supported with data.

I think Venmo would have a hard time competing with Apple or Google for in-store retail or having it adapted directly on large online retailers. Assume that I’m buying a coffee, I would either use Starbuck’s own app or Apple pay. Why would I use Venmo?

However, I do see a big opportunity in emerging markets for a credible company to control digital payments, especially with financing and microfinancing services and I think if played well, Venmo can serve to a large consumer base there. Also, being backed by PayPal brings brand recognition and credibility, which is quite important in financial services.

This 2014 Article from McKinsey argues that there is significant latent demand for digital payments in many markets of sub-Saharan Africa.

http://www.mckinsey.com/industries/financial-services/our-insights/sub-saharan-africa-a-major-potential-revenue-opportunity-for-digital-payments

Hey,

After having thought about your comment for quite a while, I personally think none of the current mobile payment options is really dominant and perfectly fulfills customers’ needs (neither I nor my friends ever pay with the phone, and I rarely see it happening in stores either), leaving enough space for Venmo:

The Starbucks App is a huge success esp. as a one-fits-all customer loyalty program, but you can only pay in a Starbucks with it. Apple Pay is proprietary, the numbers of repeat usage are poor, and overall it fell far below expectations. Samsung Pay, Android Pay and Google Wallets’ adoption rates lag behind Apple’s at this point, but they are doing better than Apple was at the same time in its rollout (http://www.pymnts.com/apple-pay-tracker/2016/apple-pays-big-drop/). Thus, the market seems crowded, but all these players might just have done a good job of paving the way for Venmo by bringing attention to the space and educating people.

I think Venmo could pull it off – their user base is huge and consists of the ideal candidates for adopting digital payment (primarily millennials who already use their cellphones to pay among each other). As discussed in class, Venmo should probably focus on convincing large merchants to accept their payment method and spend marketing money on making known where “Pay with Venmo” could be used (e.g. with stickers at the cashier).

Rolling out Venmo in other countries, emerging and also emerged (I am from Europe can totally see a use case there), seems like a great idea! I guess they focus on the United States for now and hone their business model here, before they expand internationally.

Great posting!

We already talked about how Venmo captures value. IMO, it is collecting tons of transaction date of customers and that’s what it requests users to write about transaction when they use venmo. At the end of day, these transaction data are most important ones which can directly be utilized.

I agree – Venmo probably already has more users than the nation’s largest bank (http://bankinnovation.net/2016/08/venmos-25-growth-means-it-will-soon-be-larger-than-any-bank-p2p-service/). The transaction data gathered are very valuable!