Via – “OMG another ride-sharing app?!?!” or “an Innovative one”?

Via – “OMG another ride-sharing app?!?!” or “an Innovative one”? I describe the Via ride-sharing startup that is trying to differentiate its value proposition to riders and drivers, and has also been making some strategic platform moves.

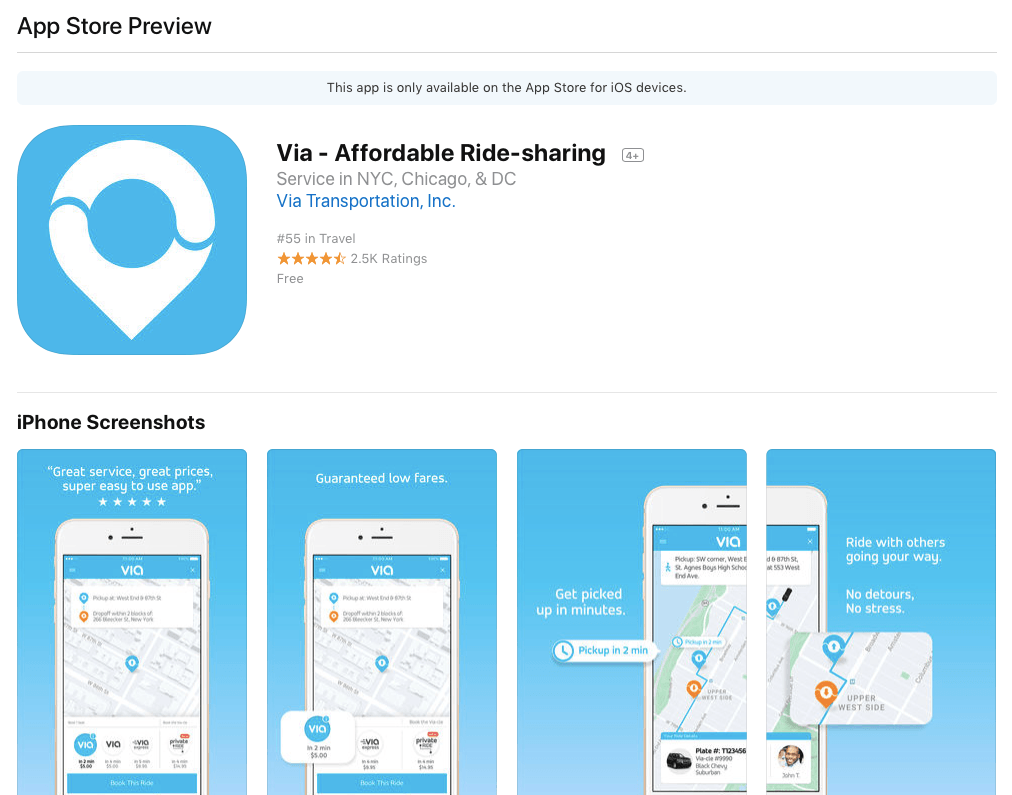

So what is Via? is a well funded ride-sharing startup currently operating in NYC, Washington D.C. and Chicago, which aims to keep rides affordable at almost the price of public transport. The company has created a platform that matches drivers with riders – needless to say not the first or last of its kind. However, the founders have tried to come up with a different take on the unit economics of “a ride”, how to keep prices low, how to maintain high service levels, how to “drive” drivers satisfaction optimal (pun intended) and, perhaps most importantly in this day and age, craft a differentiated value proposition to the two stakeholders of the platform.

So what’s Via’s status today? Via was founded by Israelis Daniel Ramot and Oren Shoval and is estimated to have grown to around 250 employees, headquartered in NYC, with current operations in 3 major US cities and more in the pipeline. As of September 2017, was estimated to be valued at $750M following a recent $250M funding led by German automaker Daimler. This investment was coupled with Daimler’s Mercedes Benz division investing $50M, forming a joint venture with the startup. Via’s prior investors include: 83North, C4 Ventures, Expansion Venture Capital, Hearst Ventures, Kapor Capital, Pitango and more. This latest investment is another testament reinforcing an interesting “strategic platform move” by Via, beyond its consumer facing business, but more on that one later.

So how does it work? Most of the basics in this ride-sharing model are similar to others: rider is matched with a driver and other riders as well going to a similar destination or along the same route. But this model, based off of Israel’s “Sherut vans” service- these are 8-10 person public transport shuttles that charge a flat fee and follow predetermined main paths in densely populated cities. Via’s app directs all riders to a near-by, walkable street corner, hereby reducing wait time and total ride time. This increases driver efficiency by increasing possible rides per hour per driver. This also makes the drive easier and safer for the driver and riders, (Via also makes the point that this is better for the environment). All of these roll into an Via’s proprietary algorithms being able to reduce ride time and ride costs. Lots of rides around Manhattan and other boroughs are as affordable as $5.

So can they make sticky? Via attempts to fight multi-homing and develop loyalty on both sides of this platform.

On the riders side, Via is attempting to attract consumers with an affordable, efficient and calm experience. Due to the path design model described above, while riders have to walk a block or turn the corner from their house, there is in total less waiting time and riders get from point A to point B quicker. Secondly, there are “ground rules” for good riders behavior, among those: no food or drinks and minimal mobile phone calls. In addition to the affordable prices value proposition, consumers pay with prepaid Via passes ,($25,$50,$100), increasing user commitment and stickiness.

On the drivers side, Via is attempting to create a true alternative to the other bigger players out there. Firstly, the compensation model is different, as drivers are paid an hourly wage, independent from number of rides or number of riders. Secondly, they are charged a lower commission, (7% for 4 person cars and 2% for 5 person car), as opposed to Uber/Lyft’s 25-30% commissions. Thirdly, the different model creates a safer and calmer work environment for drivers, which in part has led to a total of 25M rides so far.

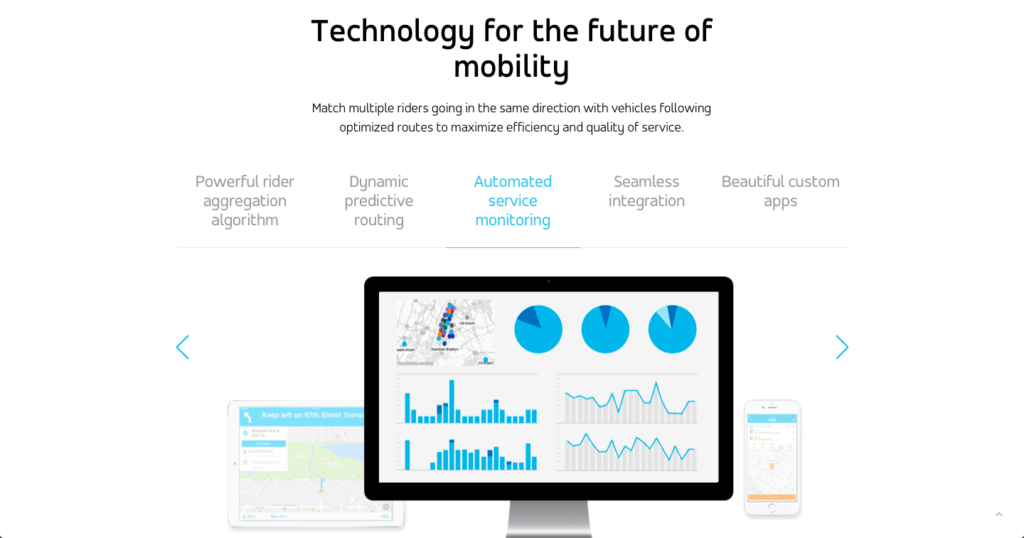

So what was that about a strategic platform move? Via’s most interesting business model innovation is attempting to build a platform on another level. Beyond Via’s brand operations, the company has been offering their SaaS solution and learnings as infrastructure in licensing deals for global partners already established in their geographies, (including Arriva and Keolis).

Certainly it is hard to predict whether any of these innovations are truly defensible in the face of aggressive competition from well funded Uber and Lyft. Will the future of ride-sharing be a winner-take-all-or-most market or will it be a more fragmented local-winner-take-all-or-most?

Time will tell.

Sources:

https://www.crunchbase.com/organization/via-transportation

Via raises $250M led by Daimler to bring its carpooling technology to Europe

http://www.crainsnewyork.com/article/20150524/TRANSPORTATION/150529933/yet-another-ride-service-only-this-one-is-different

https://ridewithvia.com; http://support.ridewithvia.com ; https://platform.ridewithvia.com

Thanks for this great post! I lived in NYC last summer and did try Via for one time. My feeling is that this model is targeting a specific, or rather a more niche, group of passengers, who may not in a rush of going to their destinations(since the cars of Via are basically 6-8 people vans, so it may take longer time than Uber/Lyft), is able to walk for a quarter mile, and most importantly want to save money. This is a service for the most price sensitive riders. But if we look at the emotion demand when we want to call a ride, it is either to save time, or to avoid walking outside in too hot or cold weathers. If I want to save money, can walk and not in a hurry, I’ll definitely choose to take the subway, instead of calling a Via. That’s why I think Via’s model still can’t solve the problem of multi-homing.