TripAdvisor: Still Flying High on its Journey to Instant Bookings

TripAdvisor will continue to be a digital travel leader with its strong competitive advantages and ability to adapt.

As you research your upcoming trip to Greece, you Google: “hotels in Santorini.”

Three months later, you wander into a charming, tiny café on a side street in Santorini. You are greeted by a friendly pair of eyes:

Sound familiar? For travelers worldwide, TripAdvisor is a trusted source for trip planning, booking, and on-location activities. As of November 2016, TripAdvisor had 390 million average monthly unique visits and 435 million reviews in 48 markets globally[1].

TripAdvisor is a deeply entrenched, scale player in the online travel space that creates value for multiple stakeholders – consumers, OTAs, and direct suppliers – while remaining profitable. TripAdvisor’s foray into UGC in 2000 shaped the way that people plan trips; what was once an offline relationship between travelers and friends or travel agents moved online into a public, social conversation. Now, nearly 17 years later, the online travel industry continues to shift as users move increasingly to mobile, Online Travel Agencies (OTAs) consolidate, and alternative travel booking sites such as Airbnb gain traction.[2] Despite a changing, increasingly competitive landscape, TripAdvisor has proven it is 1) adaptive through its shift to instant booking and 2) has enduring competitive advantages. For these reasons, TripAdvisor is still a winner.

Business Model 1.0 – Flying High with UGC

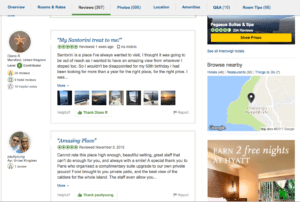

For consumers, TripAdvisor offers hotel, restaurant, and attraction reviews and photos from a trusted community. These reviews provide a behind-the-professional-photos look at the true vacation experience for millions of hotels and attractions, giving users confidence to book.

For hotels, restaurants, and attractions globally, TripAdvisor is a crucial channel for driving revenue. It also presents an opportunity to connect directly with customers via comments and additional photos. A high TripAdvisor rating is a powerful traffic driver and a widely recognized stamp of approval. Furthermore, curated lists and sorting mechanisms surface suppliers that might otherwise lack visibility.

And finally, TripAdvisor creates value for OTAs by driving business to their websites.

TripAdvisor’s revenue model depends upon the volume of users and transactions on its website. Click-based and display ad revenues have historically comprised the bulk of its revenue.

Gaining Mileage with Network Effects, Marketing, Testing Culture, and Acquisitions

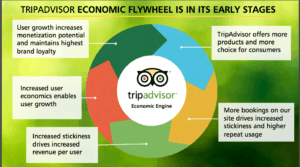

UGC is TripAdvisor’s core asset that drives the company’s network effects. The more reviews there are, the more other users benefit from additional information and forum engagement. In turn, these network effects power the company’s business model. The more users interact with the site, the more hotels and other direct suppliers such as airlines and restaurants want to join as both official members and as advertisers. Furthermore, higher volumes of user interactions build vast amounts of data that can be used for personalization, ad targeting, and marketing.

UGC powers the company’s impressive marketing engine, particularly in SEO and SEM. With a wealth of pages targeted at specific user search queries, TripAdvisor was able to gain early dominance in search engine results. The culture of testing and iteration in the product/engineering teams has enabled SEO leadership, revenue optimization, and bold moves in the user experience. [3]

Furthermore, TripAdvisor has made 26 digital acquisitions since 2007 spanning rentals, activity and restaurant bookings, and more.[4] Through these independently run companies, TripAdvisor is able to capitalize on consumer demand for highly curated travel experiences and is increasing its user touchpoints throughout all aspects of travel planning and booking.

Business Model 2.0: Riding the Instant Booking Wave

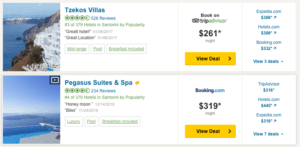

Seeking revenue diversification and greater ownership of the end-to-end travel experience, TripAdvisor introduced in 2014 an instant booking feature that allows users to book hotels directly through its website. The company seeks to capture the growing number of dollars moving to online bookings and OTAs, especially through mobile.[5] This represents a strategic repositioning of the brand as a travel review and booking site, enabling the company to diversify its revenue streams and collect powerful transaction-level data. For users, instant booking provides seamless one-stop-travel planning within one platform. TripAdvisor earns commission from top OTAs (Expedia, Priceline) and hotels on each booking.[6] From an operational perspective, the launch and development of instant booking required significant marketing, engineering, and business development/sales resources. Despite a slower-than-expected start, TripAdvisor is moving in the right direction towards becoming a planning and booking leader.

A Sky-High Competitive Advantage…with Some Speedbumps

While the OTAs fight for market share, startups offer specialized ways to plan and book trips; for example, Lola uses a combination of AI and humans for a chat-based mobile concierge, and Hopper uses big data to predict the best time to book flights for the cheapest prices. Despite this, TripAdvisor’s data, UGC, brand name, and active, loyal community are its biggest competitive advantages that will enable the company to remain a dominant player in the travel industry for years to come. Its move into instant booking is advantageous for travelers and suppliers – as long as it does not alienate loyal users by pushing bookings too hard and carefully manages relationships with competing suppliers. However, in order to stay relevant, TripAdvisor needs to focus on improving its (often cluttered) user experience, invest in new technologies (e.g., AI, VR), and continue strengthening its mobile capabilities.

[1] TripAdvisor 3Q 2016 Investor Meeting Presentation

[2] Phocuswright U.S. Online Travel Traffic Trends, July 2015

Interesting post Julia! I agree that TripAdvisor is currently a great winner and enjoy some great network effects. However, sometimes when networks get too many people on it, it actually loses some of its reliability. I hear recently more and more voices claiming that they cant trust TripAdvisor anymore, and that people are looking for alternatives and rely on recommendations only from people they can trust. Do you think this trend will continue and create a real risk for TripAdvisor?

Great post! It’s hard to find a city in the world these days that TripAdvisor doesn’t cover. It’s unfortunate though that there’s a lot of stagnation with review sites as highly rated places continue to get more ratings. Consequently, almost ironically, I’m starting to seek out review websites with a SMALLER network.

Great post, Julia! I actually did not realize how huge TripAdvisor is, with 390 million average monthly unique visits! I spent a lot of time on TripAdvisor recently planning my vacation in January and noticed the ability to book restaurants, hotels, etc. directly through the website. It is interesting that TripAdvisor is earning a commission from OTAs such as Expedia and Priceline for direct bookings rather than being considered an OTA itself. Has the ecosystem changed with the launch of TripAdvisor’s instant booking capability as new value creation or is TripAdvisor inserting itself as a new player in the ecosystem trying to capture a piece of the existing value?

Thank you for the interesting post, Julia!

TripAdvisor has enjoyed some of the advantages of being a first mover and building up strong brand awareness long before the emergence of many of its competitors. There is certainly some brand dilution happening and I’m curious how the company will handle it, particularly in the light of emergence of new competitors providing more customized and tailored offerings.

Also, in the light of ever increasing role of Social Media in building online presence and reputation, do you see players like Facebook and Google as plausible competitors when it comes to evaluating the quality of the bookings? Facebook for example has an enormous followings and many of the TripAdvisor-reviewd places have presence on Facebook.