Transferwise: Disruptive money transfer

A platform of borderless money transfer with significant cost benefit.

Have you ever remit your money internationally? Did you know how much it cost to remit your dollar and convert to some other currency?

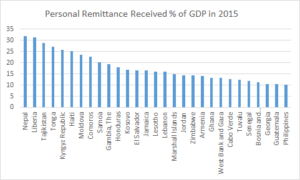

The size of money transfer industry is expected to reach around $600bn in 2017. In the U.S. alone, $54bn was transmitted abroad in 2014. According to the World Bank, there are 29 countries of which personal remittance received amount consists more than 10% of GDP.

Apparently, the money remittance makes huge impact to business and people, especially who need to work overseas and remit their earning to support their families in the homelands. However, the industry is still very inefficient and dominated by incumbent players: commercial banks. Global average total cost of sending remittance reduced from 8.93% in 2013 to 7.52% in 2015. Top US banks wire transfer costs range from $15 to $60. Considering the personal remittance amount usually stays in three digit amount, let’s say $500, it would cost 3% and up to 12%. Now you know banks takes huge cut from people who need to support their families with no or very less effort.

What is Tranferwise

Transferwise is the disruptive player in this money transfer market. Founded by the founding member of Skype, the company provides money remittance service with only 0.5% fee.

Value creation

Transferwise is like a two-sided marketplace, connecting people by matching up payments with those going the opposite direction. For example, suppose I want to pay my rent bill in the US with US dollar but I do not want to use US dollar and instead I would like to pay with Japanese Yen, Transferwise connects my transactions with someone who has US dollar but need Japanese Yen to conduct some payment. Transferwise enables me to pay my rent amount in Japanese Yen and the counterparty can use US dollar to conduct equivalent Japanese Yen equivalent, eliminating international money transfer, bypassing banks, and significantly lowering fees, up to 8 times according to Tranferwise. In addition, it is since the exchange rate is marked-to-market, it eliminates the speculation such as Bitcoin, and it provides safer and conservative money transfer compared to other disruptive service in the market.

Scaling up business

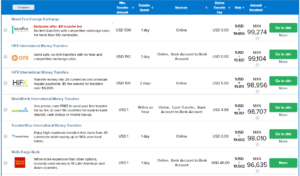

In order to make many kinds of transaction feasible, Transferwise needs to build diverse pools of the currencies and users. Today, Transferwise has over 1mn users and allows them to send money from more than 35 countries and receive money in 50 countries. Its monthly transaction. With the competitive pricing among peers, Transferwise gains customers from incumbent banks and rapidly growing its customer base.

How do various factors such as local/global network effects and multihoming affect competitive dynamics in platform markets?

Transferwise is a very customer-centric company. Perhaps it is because the founders has developed its business model to solve their personal frustration and struggle about money transfer. It’s simple and intuitive user interface and mobile application, and its obsession about transparency, such as full disclosure of cost and use of flat inter-bank rate, help building trust and loyalty which resulted obtaining more than 35,000 happy review.

How to use Transferwise

Transparency ads

Since the money transfer cost is significant, especially for those who live abroad to find job and support their families in their homeland, the cost benefit of Transferwise is enormous. Moreover, it is often the case that those people form own community and the power of word-of-mouth is really strong in the target user base, which could spread globally as the senders and recipients are across countries. Hence, the local and global network effect is strong in the market and its superior price formula would block users from multi-homing.

Potential challenges

Transferwise offers great values to the users and but it is not free from challenges. Although Transferwise has its compliance team and registered in the UK Financial Service Register, following anti money laundering and fraud compliance laws in every country they operate in, it is a young company just founded in 2011 and has shorter operating history and lean operation. If they fail to manage and prevent criminal acts, the regulatory body may impose sanction or suspend the business, depends on the level of importance.

- https://transferwise.com

- http://www.breitbart.com/big-government/2016/02/23/gao-u-s-largest-source-of-remittances-in-the-world-mexico-china-receive-most-u-s-money/

- https://www.infosys.com/industries/cards-and-payments/resources/Documents/money-transfer-industry-2016.pdf

- http://data.worldbank.org/indicator/BX.TRF.PWKR.DT.GD.ZS

- https://remittanceprices.worldbank.org/en

- https://www.finder.com/international-money-transfers

- https://www.mybanktracker.com/news/wire-transfer-fee-comparison-top-10-us-banks

- http://www.businessinsider.com/how-transferwise-works-2015-1

- https://www.quora.com/How-can-TransferWise-send-money-internationally-without-being-illegal

Very interesting business, and it instead need large pool to make matching efficient. Have you heard Ripple, which is tackling this problem in a similar way? It helps bank to settle transactions cross borders to fast, efficient, and at low cost.

Jing, thank you for the comment. I did not know about Ripple. I believe many people realized the market opportunity in the money transfer market but Ripple seems it takes a position to co-exist with the incumbent money transfer system, providing efficiency and cost reduction to banks. It may have a better positioning than Transferwise in terms of avoiding retaliation from incumbent players.

Thank you for sharing Tomo. I am a big fan of Transferwise and have been using it for years. One of the things I struggle with the app is the speed at which transactions take place. Settlement time has been reduced, but it still is slower than a bank wire. With the advent of bitcoin and other cryptocurrencies that promise lower transaction costs and shorter settlement periods, do you think there is a space for Transferwise to innovate in this nascent field?

Techie, thank you for the comment. Actually I’ve never used Transferwise but happen to know when I moved here and urgently needed dollar (at that time I used wire transfer from a Japanese bank to Bank of America and the cost was about 2% and I was furious). I use Bitcoin and the settlement speed is as fast as bank wire (2 business days). I understand the transaction speed of Transferwise (according to Transferwise it takes 1 to 4 business days) cannot match up with some of competitive services but improving transaction speed is one of the top priorities of the company (according to a former PM of Transferwise, found her comment via Quora) and I believe they are committed to improve this area going forward.

I love Transferwise! I use it frequently to transfer euros here in the US. It’s impressive how much cheaper it is to use Transferwise versus a standard bank transfer. A couple of questions come to my mind as I think about their business model.

(1) Do you think Transferwise is threatened by the emergence of cryptocurrencies such as Bitcoin, which supposedly should provide even lower transaction costs?

(2) How scalable do you think Transferwise’s operating model is? The matching model seem to only work as long as the transfers are balanced on both ways, otherwise the company would have to accumulate cash in one currency, which creates FX risk. I wonder how the company deals with swings in demand.

Finally, I agree with you that regulation such as anti-money laundering and anti-terrorism financing are going to be a key subject that the company needs to deal with. I am excited to see how well they’re going to be doing in 5 years.