The Battle to Book and Host Travelers Continues to be Changed by Digital Innovation

Digital disruption has had a huge impact on the hospitality industry. Companies like Airbnb and Priceline have done a great job of creating digital platforms and applying pressure to traditional hotels, but hotels are fighting back with consolidation and differentiation.

Hospitality and Lodging is a traditionally physical industry that has seen plenty of digital disruption across the last decade with a list of winners and losers that is still being defined. In this post, I will review four players, home sharing platforms (Airbnb), online travel agents (Priceline) traditional hotels (Marriott), and traditional (offline) travel agents.

Winner – Home sharing platforms

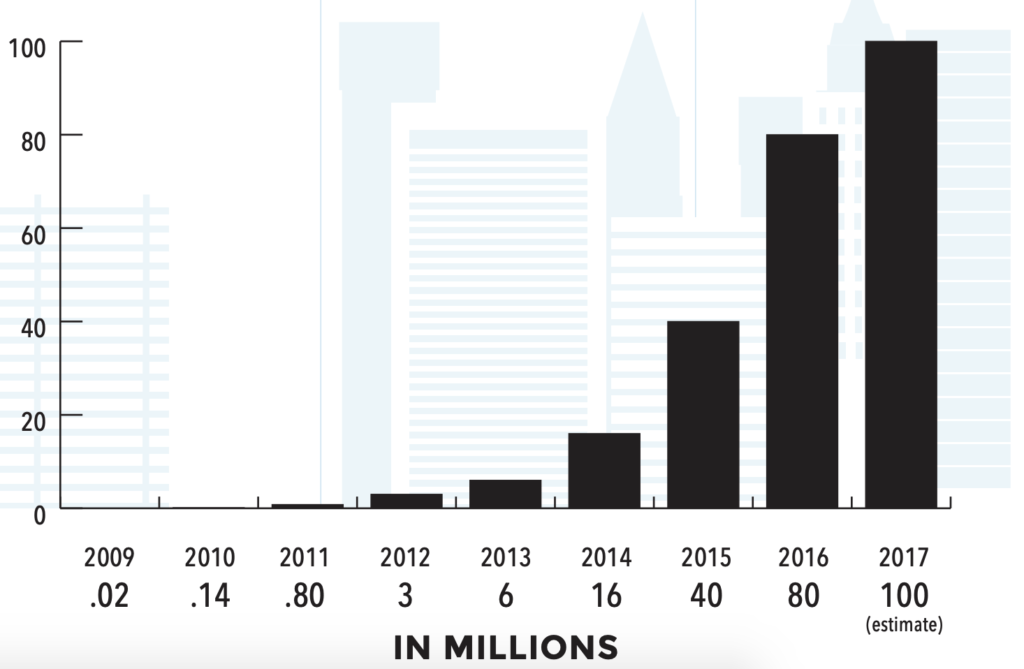

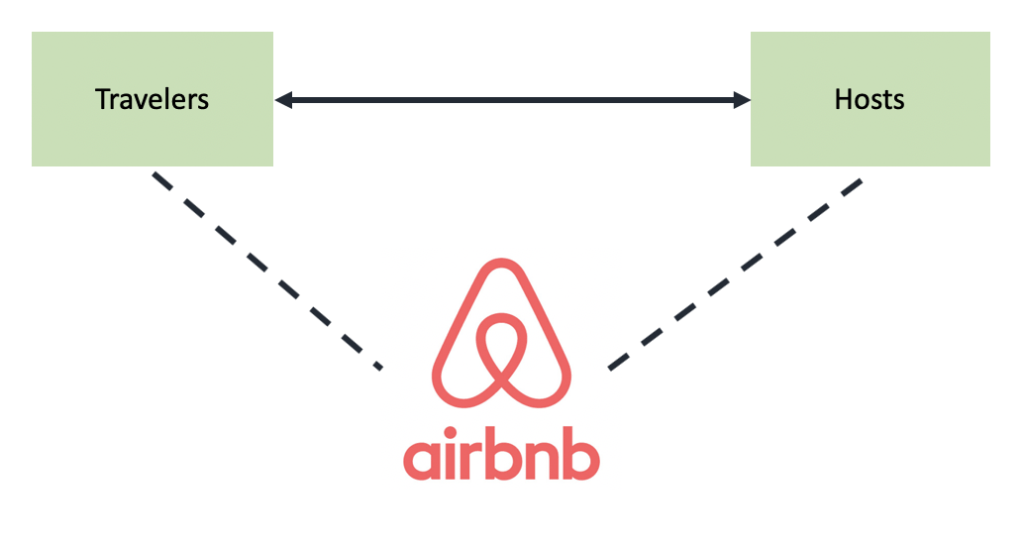

Currently, it appears Airbnb and HomeAway will be two of the big winners of the digital disruption and transformation of the hospitality industry. For the purposes of this post, I’ll focus on Airbnb, but much of the value creation and capture could be applied to HomeAway as well. Airbnb is now in 191 countries, with 100 million guest arrivals per year, 3 million listings, and a $31 billion valuation (as of Sept 11, 2017) [1]. The growth rate of arrivals has been incredible with a cumulative annual growth rate of more than 100% since 2011[1]. While Airbnb has experimented with many offerings they are fundamentally a matching platform between travelers and lodging providers. It is instructive to evaluate the value creation and value capture of Airbnb’s platform.

- match users looking for a place to stay with the unused elastic inventory of lodging

- avoidance of hospitality taxes (in some regions)

- enabling more unique experiences for guests

- enabling hosts to rent out space without long term commitments (like yearlong leases)

As a platform, Airbnb has managed to build some great assets including a huge user base (they have more listings than Marriott has hotel rooms [1]) and a massive data set on travel characteristics that they have built over the past decade.

Value capture

- predominantly a service fee per transaction charged to the guest

The logical tension between their value creation and value capture is the risk of disintermediation. Thus far Airbnb has largely been able to avoid large scale disintermediation for a couple of reasons: the trust they create by holding money in escrow, the value they add by providing guarantees to both parties (hosts are insured by Airbnb, guests are guaranteed that Airbnb will find them an alternative place to stay if the host does not maintain their end of the agreement). Airbnb is also continuing to deal with reactive legislation that can limit their ability to operate and create value in certain geographies. Some examples of this are an occupancy tax in San Francisco [2] and New York City imposing very strict rules limiting short term rentals [3].

Airbnb has thus far used the puppy dog ploy [4] very successfully by not making a huge push into business travelers, as 90% of Airbnb customers are still leisure travelers [1]. However, as Airbnb looks to go public (possibly in 2019) expect them to push further into the business traveler market.

Winner – Online travel agents

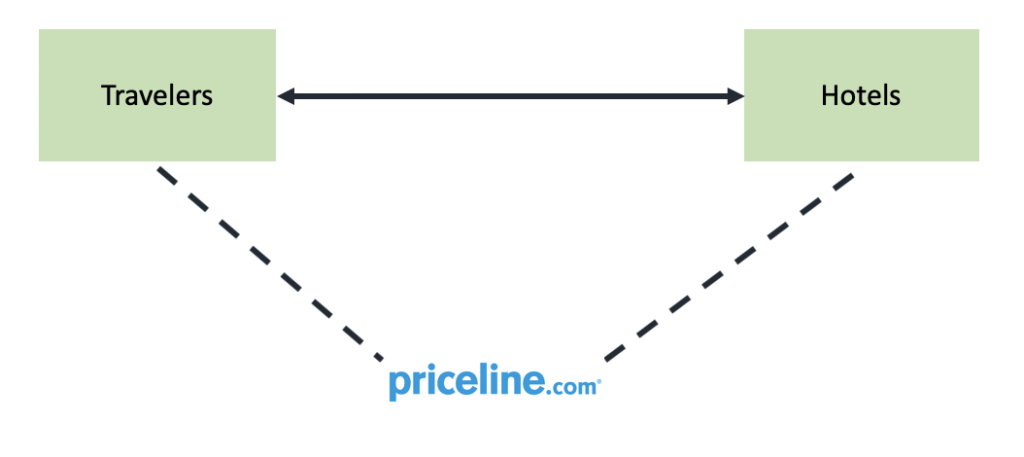

Another area that has seen tremendous (and profitable) growth has been online travel agents (OTAs) like Priceline and Expedia (note Expedia also runs a large merchant business and owns HomeAway). Again to focus this discussion I’ll just discuss Priceline’s OTA business. In the last reported quarter, Priceline’s parent company (Booking Holdings Inc) brought in $4.9B in revenue [5] and currently has a market capitalization of just under $90B (as of Feb 27, 2019). The majority of these revenues come from Priceline’s agency business. The Priceline OTA business model is to list hotel rooms on its website and take a commission of any bookings that take place through the platform.

Value creation

- reduces search costs for guests, instead of having to call many individual lodging options, or having to visit many different websites a user can open up Priceline and see a list of available hotels and their prices

- provide an easy comparison of hotels for guests (standard formatting, standard information)

- allow guests to review hotels, sharing info on quality

- possibly reduce customer acquisition costs for hotels (particularly small hotels) by:

- providing hotels with a large amount of potential traffic that may not have otherwise considered the hotel (perhaps a small independent hotel, or because the guest has a different brand loyalty)

- helping hotels solve the problem of perishable inventory (if a room is not rented out for a night the owner can never recover that lost revenue) by bringing a wide range of potential guests

Value capture

- Priceline captures value by charging commissions of 10-30% on all bookings [6].

These commissions are variable based on a couple of factors including how high a hotel is ranked in search results. Unlike a merchant model (outside the scope of this post) the agency only transfers money when hotel rooms have been booked, so Priceline’s OTA does not need to hold any inventory. Depending on the hotel this 10-30% commission can represent a lower cost of customer acquisition than other methods [6].

OTAs like Priceline also fit the definition of a multi-sided platform because there are cross-side network effects between hotels and guests, but the platform has no limiting long-term commitments and does not own any of the hotel room inventory. However, this is not a winner take all market, mostly due to the low cost of multi-homing for both guests and hotels. Therefore, Priceline must continually invest in marketing ($1.4B last quarter) as well as developing its information technology to be best in class ($58M last quarter) [5].

Under attack – Traditional hotels

The traditional model of a hotel is under attack, but their fate is yet to be determined. A hotel traditionally requires a large capital outlay that is then paid back over time by maximizing the rent that can be extracted through their perishable inventory. Many people speculate that hotels are consistently being eroded by digital platforms much like how Netflix killed blockbuster. However, the data tells a different story, research from Harvard Business School professor Chiara Farronato and collaborator Andrey Fradkin found that Airbnb has very little impact on hotel occupancy rates but Airbnb is eroding the pricing power of hotels. This is Airbnb exploiting the fundamental weakness in the hotel business model, fixed investments costs. Hotels are unable to vary their number of rooms dynamically so they rely on maintaining a normal level of occupancy while extracting higher prices during peak times. Farronato’s research found that during peak times the number of Airbnb listings tend to swell limiting the ability of hotels to extract a higher price from guests as they used to do [7].

Given this change, hotels are seeking other ways to improve their value creation and value capture. Hotels have also gone through a wave of consolidation (Marriott buying SPG [8]) to enable them to expand on their ability to offer a brand promise, including comprehensive loyalty programs and brand expansions (Marriott now has more than 30 brands [8]) to meet the needs of many different customers, particularly the generally less price sensitive business travelers.

The major hotel chains have also made a big push into recapturing value by disintermediating the online travel agents. Marriott is now guaranteeing that their websites will have the lowest price available on the internet in order to entice customers to shop directly through their sites and avoid the high commission fees they pay online travel agents (discussed above) [9]. They are even further backing up this brand promise by providing extras to members of their loyalty program that book on their sites (example free Wi-Fi) and a promise that if the same hotel is ever found cheaper on the web they will match the price plus an additional percentage (an offer I’ve been fortunate to take advantage of once) [9].

Hotels are still certainly not dead, in the last quarter Marriott announced an adjusted EBITDA of $900M, a 12% year over year increase [8]. However digital disruption certainly has the ability to negatively impact their business and they will have to continue to adapt their business strategy to survive the wave of transformation.

Loser – Travel agents

One undisputed loser in the digital disruption of the hospitality industry has been the traditional travel agents. While estimates disagree, consensus is that the number of travel agents in the US has been falling steadily in the last two decades, with the bureau of labor statistics reporting that travel agents in the US have fallen from a peak of 124,000 in 2000 to 64,000 in 2012 [10]. The ability of users to design their own itinerary, book instantly, and extract trust through communities of online reviews has largely replaced the traditional value creation offered by traditional travel agents.

Summary

Digital disruption has had a major impact on the hospitality and lodging sector. It has enabled the rise of home sharing platforms and online travel agencies. It has forced hotels to rework aspects of their business model, consolidate, and differentiate. The transformation has also led to the slow and continual decline of the traditional travel agent. The industry will continue to see change, the next two battles that I believe will be very interesting to watch will be if Airbnb makes a push into business travel (perhaps with a loyalty program) targeting hotels where they have been building differentiation, and how hotels will continue to push back on the value currently being captured by OTAs.

References

[1] Vizlly.com. (2019). [online] Available at: https://www.vizlly.com/dl/Leo_Info_Airbnb_17.0335.pdf [Accessed 27 Feb. 2019].

[2] Airbnb. (2019). San Francisco, CA. [online] Available at: https://www.airbnb.com/help/article/871/san-francisco–ca [Accessed 27 Feb. 2019].

[3] Tabor, N. (2019). Is New York Cracking Down on Airbnb to Help Local Residents or Hotels?. [online] Intelligencer. Available at: http://nymag.com/intelligencer/2018/08/airbnb-new-york-crack-down.html [Accessed 27 Feb. 2019].

[4] Yoffie, D. and Kwak, M. (2002). Judo Strategy: 10 Techniques for Beating a Stronger Opponent. Business Strategy Review, 13(1).

[5] Ir.bookingholdings.com. (2019). [online] Available at: http://ir.bookingholdings.com/static-files/2b224884-5655-4671-a9ee-d0c4100e4213 [Accessed 27 Feb. 2019].

[6] Uenlue, D. (2019). Business models Booking.com, Expedia, TripAdvisor. [online] Innovation Tactics. Available at: https://www.innovationtactics.com/business-models-tripadvisor-booking-com-expedia/ [Accessed 27 Feb. 2019].

[7] HBS Working Knowledge. (2019). The Airbnb Effect: Cheaper Rooms for Travelers, Less Revenue for Hotels. [online] Available at: https://hbswk.hbs.edu/item/the-airbnb-effect-cheaper-rooms-for-travelers-less-revenue-for-hotels?cid=spmailing-19102256-WK%20Newsletter%2002-28-2018%20(1)-February%2028,%202018 [Accessed 27 Feb. 2019].

[8] Marriott International. (2019). Marriott International Reports Third Quarter 2018 Results | Marriott International. [online] Available at: https://marriott.gcs-web.com/news-releases/news-release-details/marriott-international-reports-third-quarter-2018-results [Accessed 27 Feb. 2019].

[9] www.marriott.com. (2019). Online Hotel Booking and Reservations | Book Right on Marriott.com. [online] Available at: https://www.marriott.com/online-hotel-booking.mi [Accessed 27 Feb. 2019].

[10] Travelweekly.com. (2019). How many travel agents are there?: Travel Weekly. [online] Available at: https://www.travelweekly.com/Travel-News/Travel-Agent-Issues/How-many-travel-agents-are-there- [Accessed 27 Feb. 2019].

Awesome post! I remember in RC year we talked about Marriott’s push to offer Airbnb-like services. Do you envision a future for these asset-heavy hotels in which they can adopt the kinds of digital strategies that the new tech companies like Airbnb employ?

I think all the current trends are towards hotels continuing to be pretty asset heavy. But I can imagine a world where they look at the publicly available data on Airbnb (listings, reviews, etc) and use it to adjust their investments (ie maybe deciding to build three bedroom hotel rooms with shared kitchens for families), or looking to leverage digital technology to make the physical use of the space more flexible. The extreme of this adjustment would be investing in things like town houses or small individual apartments to offer a very similar experience to AirBnb but branded as a hotel.

From a friend working at Marriott over the summer, I think esp with the finalization of their merger with SPG, the company is focusing A LOT of energy on keep its place at the top for travelers. I think this story definitely has a long way to play out ESP. given PCs points on regulation. I think AirBnB is going to face a lot of pushback (similar to Uber) in the way its spread in major cities across the world, especially in those that are facing affordable housing shortages.

I think it will be interesting to see how regulation in this space plays out. I agree that AirBnB creates a lot of value, but perhaps unintentionally, in many cities AirBnB has led to a reduction in the availability of long-term housing rentals as property managers and investors realize they can extract more value from the booming short-term rental market. In addition to SF and NYC that you mentioned, Boston is currently struggling with this, and some new regulations just came into affect limiting investors’ ability to list on the platform.

While I definitely don’t want AirBnB to go away, HBR put out an interesting article a few years ago called “Spontaneous Deregulation” that discusses Uber & AirBnB’s “beg for forgiveness” v. “ask permission” approach to the legal boundaries they come up against. The article argues that AirBnB is able to provide a lot of the value that it does because it ignores zoning, tax, and safety regulations, and talks about the dangers of private companies that simply decide that laws aren’t necessary and are able to fly under the radar initially because they’re small compared to the overall market. There is an argument to made that certain regulations and precautions are no longer necessary, and that the entire point of innovation if for companies to change the status quo, but I do wonder how approaches to regulation will evolve as these kinds of private companies with transformative business models consume a larger and larger share of their markets.

https://www.wbur.org/bostonomix/2019/01/01/airbnb-boston-ordinance

https://hbr.org/2016/04/spontaneous-deregulation

PC, Thanks for sharing the article.

I completely agree that there is argument to be made that Airbnb has hurt the long term rental market by causing property managers to choose short term rentals over long thus reducing the supply of long term rentals. In fact the building I live in appears to keep several units set aside just for short term rentals, despite specifying in my lease that I am not allowed to rent my apartment in a short term manner. I do wonder if this will be a permanent market adjustment though, or if regulation and general supply and demand will help us find an equilibrium between short and long term rentals, as long term rentals do still offer some benefits to property managers (predictable cash flows over a long period) particularly in markets that aren’t subject to rent control like Boston.

To your second point, I think it’s very interesting to watch how the “ask for forgiveness” wave of tech innovation has played out. To a certain extent I think we even saw this with Amazon, an initial key benefit of theirs was the lack of sales tax which they used to gain scale, now that they have scale they collect sales tax, but I wonder if they could have ever achieved scale without first maneuvering around this rule. It’s also been very interesting to watch the electric scooter battle play out as municipalities that feel burned by Uber and Airbnb have taken a very clear “ask for permission or leave” approach, perhaps even over correcting.

So, I think like many waves of innovation, this hits the lower tier offerings first. Airbnb is not disrupting Mariott hotels any time soon, but might it take a lot of business from, say, Motel 8?

Fidel,

Totally fair point and I think we’re starting to see some of that, while it’s difficult to get data on a lot of those lower tier brands (Motel 6 is private, super 8 is part of a larger hotel conglomerate) I was able to find detail on Extended Stay America. Just a brief look at the latest earnings release shows that they’re seeing year over year decreases in adjusted EBITDA and operating margin which could certainly be signs of this erosion.

https://www.aboutstay.com/static-files/9a1eb92f-5235-4d79-a7e0-7d50a0671083

Great post, I analyzed Airbnb as well.

During my research I found that Airbnb is partner with real estate developers to make Airbnb specific properties. I found this to be very interring given that the platform’s value proposition was an asset light model when it began. Here is a link to the Airbnb home sharing community, Niido.

https://www.niido.com

Great post! There’s a recent Planet Money podcast that I’d recommend where they profile the effects of Airbnb in New Orleans, and it provides some more examples of winners and losers in that case. The city was super lax at first with Airbnb regulation, which allowed many struggling entrepreneurs to make good living wages in the city and helped them fix up old, decrepit homes. On the other hand, some people complained that it was ruining the culture of the city because entire blocks of homes became rental properties and lifelong residents moved out while destructive bachelor parties moved in. The city then reactively passed super strict regulation and now they’re in an awkward situation where those entrepreneurs lost their source of income, and entire blocks of homes are sitting empty.

Thanks for the suggestion MS, I’ll be sure to check that out as it sounds like New Orleans is a great example of what can happen when a new platform doesn’t work proactively with regulators.

Great post! I like that you mentioned Airbnb is planning to target the business travellers in the next few years that I had not thought about before as a leisure traveller. You mentioned that there are very high occupancy taxes in NYC and SF. I’m very interested in learning why they impose such tax and are they applicable to hotels as well? Also something I’m interested in seeing is the competitions within the online platforms themselves. Would you think Airbnb grabbed market share from Priceline? Will they co-exist going forward or someone is going to take the entire market.

Great article and topic.

I have been interested to see that in recent months some hotels / smaller B&Bs have been using Airbnb as a viable alternative booking channel to traditional OTAs. On a recent trip to Napa, I noticed full-service hotels being offered side-by-side with private homes.

This makes sense to me; Airbnb’s fees are usually ~20%, below the ~30% charged by many OTAs. I hope to see this continue in the future. I find that comparing Airbnb options to hotel options is usually the decision that I, as the consumer, am attempting to make.

Ganesh