Sephora: Staying Relevant in Brick and Mortar

An inside look at how Sephora uses technology in its stores to stay relevant in rapidly evolving times.

Sephora has been a trailblazer in the U.S. beauty retail industry. From its early days, Sephora leveraged digital technologies toward a singular focus: to create an outstanding shopping experience for its customers, whether in-store or online. Sephora was among the first beauty retailers to organize stores by product instead of brand, to launch an e-commerce platform, to launch native mobile apps, to integrate with Pinterest, to use beacons in store, to introduce mobile POS systems…the list is endless. It is therefore no surprise that between 2010-2017, Sephora’s U.S. revenue is expected to grow at 10% per year, far outpacing industry average.

Let’s take a look at how Sephora creates value in this highly competitive and saturated space, and how its operating model supports this ongoing focus on innovation through digital technology.

Value creation: Leverage technology to create an in-store playground

Unlike other retailers, Sephora is not another shop where customers go to make purchases. Instead it is a playground where anyone can learn, play, try, and engage with products at their own pace. Customers have access to just the right amount of information, as they need it, tailored to their needs, knowledge and interests. Here are some examples of the latest digital innovations to support Sephora’s retail philosophy.

Beauty TIP Workshop:

New stores come equipped with a workstation of large digital screens where customers can take group beauty classes from in-store facilitators, access self-guided online tutorials, or browse Sephora’s Beauty Board: a user-generated photo gallery from which customers can directly make purchases.

Beauty TIP stands for Teach, Inspire, Play – and this workstation lets customers do just that.

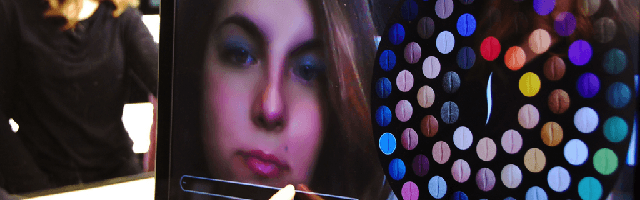

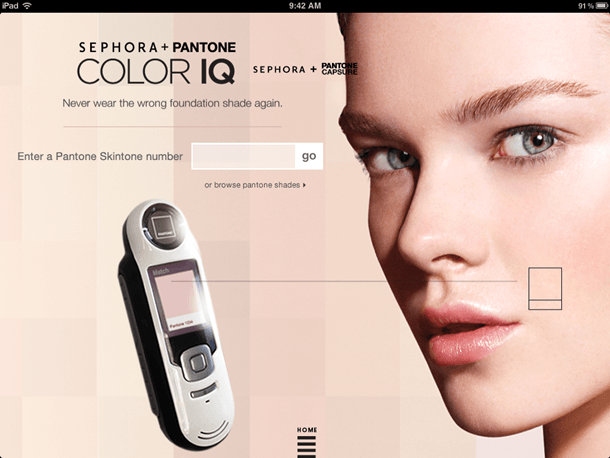

Find it with Color IQ:

Sephora has partnered with companies like Pantone to provide personalized product recommendations based on the exact tone of your skin or lip color. A device scans your skin and provides you a personal “Color IQ” number. It then searches the database on Sephora.com to recommend the perfect product for your personal shade. When I first tried this feature, within 2 minutes I was recommended the shade “Punjab” by Nars…Punjab just happens to be the state in India where my ancestors are from! I would have never known such a product existed, let alone that it was practically made for me. Talk about a personalized experience.

Forays in Augmented Reality:

In April 2015, Sephora started experimenting with AR experiences in store through the Sephora iPhone app. Customers simply use their phones to hover over images in store to pull up a variety of exclusive content for exploration: from interviews with cult beauty brand founders like Josie Maran to relevant YouTube playlists or reviews on Sephora.com. In 2016, Sephora launched Sephora Virtual Artist, enabling customers to try on different shades of lipstick using facial recognition features similar to Snapchat’s filters.

This space for exploration attracts both beauty experts and novices to Sephora whether in store or online, and creates ample opportunities for demand generation. If you discover something you love and want to purchase it – great! The value capture model is pretty standard but Sephora customers tend to be sticky due to a compelling loyalty program and generous return policies (you can return anything you buy – even after using the product!)

Operating model: Innovate at all costs and always think digital

Sephora’s operating model is what enables them to create these unique retail tech-forward shopping experiences.

Firstly, their U.S. headquarters are deliberately located in San Francisco (an atypical choice for most retailers), but perfect for proximity to the latest digital innovations and experiments in the Bay Area. This also gives them access to strong tech talent – Sephora has a CTO with deep e-commerce experience and invests heavily in its in-house development teams.

Moreover, Sephora went through a reorg in 2013 where they merged the traditional marketing and digital marketing organizations, aligning their incentives and rolling them up to a single CMO who also served as the CDO (Chief Digital Officer). This removed any conflicts between the “Traditional” and “digital” arms of the organization. The act of putting a digital officer in the C-Suite further signaled to the organization that digital was critical to the success of the company.

Most recently, Sephora U.S. launched Sephora Innovation Lab – a think tank to uncover the most innovative ideas for Sephora’s retail experience, that brings together cross-functional teams from across the company to brainstorm, prototype and launch ideas for the future of shopping. Calvin McDonald, president and CEO for Sephora Americas said “The Innovation Lab will cull the collective creativity of Sephora’s employees in a bid to enhance Sephora’s digital future.” The lab is also aimed to groom the company’s future digital leaders.

Working on new ideas inside the Sephora Lab

Looking ahead

Sephora continues to invest and organize around digital innovation in beauty retail to stay ahead of the technology curve and maintain relevance with its in store and online offerings. While Amazon has tried to make strides in premium online beauty retail, investing more than Sephora in recent years, it remains to be seen if it can offer a truly differentiated, superior customer experience like Sephora does in this space.

References

A number of articles were referenced in writing this blog post:

- http://clients1.ibisworld.com/reports/us/industry/majorcompanies.aspx?entid=1055#MP406554

- https://www.buzzfeed.com/sapna/sephora-goes-digital?utm_term=.xlp4kV0aP#.raK6JAjl0

- http://www.forbes.com/sites/barbarathau/2015/03/06/sephora-grooms-digital-leaders-with-innovation-lab-debuts-mobile-experiences/#4b7e3215553e

- https://hbr.org/2014/06/how-sephora-reorganized-to-become-a-more-digital-brand

- https://www.lvmh.com/news-documents/news/sephora-lab-collaborative-innovation/

- http://beautystat.com/site/makeup/cosmetics-industry-market-trends-statistics-2016-2017-sephoras-new-concept-store-beauty-tip-workshop-for-makeup-skincare-fragrance/

- https://www.lvmh.com/news-documents/news/sephora-flash-the-connected-beauty-store/

- http://www.investors.com/research/the-new-america/beauty-ulta-sephora-immune-to-amazon-effect/

- https://www.demacmedia.com/ecommerce/pokemon-go-the-future-of-retail/

Ravneet, this is fascinating! I love Sephora but honestly didn’t know about all of these different ways they were leveraging digital to maintain their presence. I do love the idea of ColorIQ, in particular, as I think it addresses a real consumer problem.

The one question I have is: do you think Sephora will need to divest some of their stores and reduce their brick-and-mortar footprint, eventually? Or is it essential that they maintain the store presence in order to persuade customers to buy and remain loyal? Physical stores are always going to be expensive, and unless they can take some of that PPE off the balance sheet, the value proposition is still tricky.

I went to Sephora stores a few times (SURPRISE?? Well I went with my girlfriend). While she enjoys the customer experience, I was marveling at Sephora’s amazing operating model. Yes I tried Sephora Virtual Artist, too! But it didn’t suit me…

Now lets discuss physical stores.

Firstly, I think they might be cheaper in future as other shops close down, and rental prices drop. Usually, the store in a mall that draws the most traffic often gets discounts on rental, while their neighboring stores pay extra for the “benefits” of the traffic.

Secondly, offline experiences still offer values that online experiences lacked so far. As online sales became more prevalent, the gap becomes more prominent. Think why Apple runs expensive, high-traffic retails stores that operate at a loss? Both Sephora and Apple Stores understood their value of offering hands-on product trials and personal consultation services. Neither Sephora consultants nor Apple geniuses get commissions on sales, but they were incentivized to help customers find the right items in the stores, and were praised or rewarded on delivering good services. Furthermore, while most cosmetics brands struggle to maintain customer touch at reasonable costs, Sephora pools all their problems together, and solve them with one Brick and Mortar solution.

In conclusion, going digital is not the solution to all problems. What digital cannot solve, becomes the opportunity for non-digital.

This makes me think that while autonomous driving cars will replace passenger cars, it will leave a significant niche market for fun-to-drive cars. An self-driving Ferrari will never work…

Thank you for sharing, Ravneet – this post was really interesting! Like Sonali, I am a Sephora loyalist but had no idea about any of these services. For me, the value proposition is about consistency (I know that I can find the brands I like), shopping history (I can easily re-order), customer service (easy returns), trialability, and perhaps most importantly, the rewards program (I hit my 500 point gift more frequently than I would like to admit…). This leads me to wonder how important these digital innovations are for the vast majority of consumers – are they nice-to-haves used by a select few, or truly the future of makeup consumption? What can Sephora do to generate awareness about their new technologies and test their true value for the business?

Ravneet, this is absolutely fascinating! I love to see these examples of successful brick & motor retailer in the age of e-commmerce. It’s definitely a model that some retailers can learn from, creating the shopping experience that e-commerce cannot offer.

I am curious about how Sephora see their omni-channel strategy, such as the profitably of online vs brick & motor sales, their ideal mix of the 2 channels, and the value propositions. As online personalized recommendation capability develops, the online shopping experience enhances, e-commerce competitors getting aggressive, and consumer continue to move online, will they still see brick & motor as a point of sale in the future? Or will they view it as show-rooms where the customer can interact with the brand?

Nice post, Ravneet. Sephora was one of the clients I worked with at Medallia, and I was very impressed by their adoption of digital technologies to improve customer service. Medallia helped Sephora track customer satisfaction metrics and service-related issues through online surveys, and Sephora was quite proactive about both monitoring results as well as looking for ways to utilize the data to further strengthen customer loyalty. They had high NPS ratings, especially for the retail segment (and I’m guessing that has not changed).

As I’m thinking about Sephora’s business model, it seems like many of the brands that Sephora features do not have strong online presences currently. Some of them primarily sell through Sephora and department stores’ online sites (i.e. Bloomingdale’s, Macy’s) while others actually want to emphasize the in-person experience of going to a brick-and-mortar store. As digital technology improves and brands embrace online channels more readily, do you think that Sephora’s business is at risk? My initial thinking on this question is that the percentage of online sales for beauty will continue to increase steadily, but the brick-and-mortar channel will still be fairly resistant over a long period of time (similar to how pharmacies like CVS and Walgreen’s have stayed in business despite Amazon’s growth).

Ravneet, great post and thanks for sharing! Retail seems like an interesting space ripe for disruption with Amazon also making moves with Amazon Go. Do you have any sense of Sephora’s split of sales through digital vs retail stores or any other form of attribution that they do for their digital strategy? Also, how have other competitors responded to this growing digital preference of consumers?

Great post, Ravneet, thanks for sharing! I agree with your description of the store experience being like a ‘playground’ for women, it is indeed this experience that drives up their sales. However I am curious to see whether they can sustain this level of technology investment going forward. Do you have a sense of how they are funding their investments? Do they have high margins on certain products or is it their sales volume that help subsidize the cost of new technology employed in stores?

Great post! I am a loyal Sephora VIB and did not know about some of these tech-enabled value-add services. While some seem more frivolous than others, it is really exciting to see a retailer with such a massive physical presence embracing the digital world. My question relates to brand/product disaggregation — some modern beauty brands have built a cult following by going direct to consumer (mostly online) or by establishing a viral social media presence (e.g., Glossier). How do you think Sephora will fare as beauty brands have additional channels to market and sell directly to their customers?

Great post! Such successful adaptations of digital marketing by a traditional offline retailer are indeed rare to find. Sephora does a great job in driving traffic and trial, guess the challenge lies in deal closing. It is simply too convenient for a customer to find the product she likes in Sephora and then buy it at which ever e-commerce website offering the best price. And online retailers become free riders that don’t need to bare the high brick and mortar, and technology cost. Thus the question goes back to how Sephora can close the deal in its own online and offline eco-system even if it may not be able to offer competitive prices, and if the target customer is willing to pay a premium for the experience she enjoys at Sephora.

I think you bring up some great points about Sephora’s innovations in the retail space, but I would also highlight their innovation on their website as well. Sephora has shown how to go up against an eCommerce behemoth like Amazon – do well what they do poorly (curated product line, education, high-quality content, free samples, loyalty system) while still emphasizing customer service (Amazon’s strength). Sephora does this by utilizing a robust customer review section, a relatively good shipping system (3 day free shipping with orders over $50), and an easy return process. I think they are an example of creating a cohesive omnichannel system as Megan points out.

Ravneet, great post. I’m curious about Sephora’s long-term omnichannel strategy. I worry that their storefronts are more and more becoming showrooms that simply drive online replenishment cycles. Since their offline locations are typically in high foot-traffic / volume retail spaces (ie, expensive leases), I wonder how essential this offline presence really is and if the capex could be significantly reduced with smaller or fewer stores. I agree that it’s an essential part of the experience and enhances brand stickiness / deep engagement – I’m just wondering about the ROI.

Love your post! Sephora is one of my favorite stores, partly because of the ‘discovery’-oriented atmosphere. At the same time, the try/play strategy is also why I return a ton of products back to Sephora, especially if it’s an online purchase..Their great return policy means I’m encouraged to purchase a ton of items online, try them out, and return the many that don’t work out. Costs associated with returns is one of the biggest expenses for retailers and I’m guessing it’s the same if not even worse for Sephora (Sephora employees told me returned items are discarded). As eCommerce continues to increase, do you think Sephora needs to re-think this strategy, or will it be net-net more beneficial? Should Sephora discourage exploratory purchases via digital channels?

Ravneet! Thanks for sharing more about Sephora in class. Really interesting to see how Sephora is bridging the divide between brick and mortar and the digital world. As a Sephora customer myself I can see the value created by the digital initiatives you’ve outlined. However, I’m still somewhat concerned by their ability to capture that value. I’m not sure there’s much keeping a customer from partaking in the in-store innovations to discover products, and then purchasing those same products on Amazon at a lower price point. I definitely understand your point that Sephora has developed great customer loyalty, and I also believe there is an immediate gratification from buying the product in-store, but I imagine there will always be a subset of price sensitive customers that will go to a player like Amazon that can offer the lowest price just by virtue of their scale. Thanks again for sharing – looking forward to testing some of these things out.