Robo Advisors and the business of automated advice

Roby advisory (“robos”), are low-cost automated investment platforms that utilizes mathematical algorithms to support investment decisions and create diversified financial portfolios. Analysts predict that by 2020 broadly defined robo advisory services are expected to manage between $2.2 to $3.7 trillion in assets. Can they replace a human Financial Advisor and become the main stream asset allocation solution?

The concept of robo advisors was pioneered in 2008 by Betterment and Wealth front. Today they are roughly 100 different robo advisory platforms, across 15 countries. Analysts predict that by 2020 broadly defined robo advisory services are expected to manage between $2.2 to $3.7 trillion in assets. By 2025 this figure will reach $16 trillion.

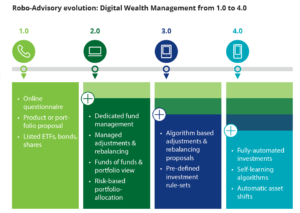

Roby advisory (“robos”), are low-cost automated investment platforms that utilizes mathematical algorithms to support investment decisions and create diversified financial portfolios. As a new investor, robo advisor will determine an optimal portfolio of assets that takes into account individual risk appetite and liquidity needs, based on factors like age (i.e. years to retirement), saving amount and any upcoming liquidity events (e.g. buying a house) among others. Based on this recommendation, the money is then invested using mean-variance optimization for asset allocation. The more sophisticated robo-advisory solutions learn continuously from historical data based on performance of assets, and other individual portfolios with similar risk preference and rebalance the portfolio automatically, without a human interference.

Robo advisors create value in two ways. Firstly, they give retail investors access to invest their wealth at a much lower cost. A traditional mutual fund would charge anywhere between 150-250bps depending on strategy versus 4-12 bps for robo advisory solution. Secondly, the asset allocation part of the solution acts as a personal Financial Advisor (FA), someone who historically has only been accessible to high net worth individuals. Suddenly, everyone can get an individual recommendation for an optimal portfolio in a matter of seconds due to digital onboarding. This, combined with no (or low) minimum investments required, means that many people who do not have the time, financial knowledge or substantial savings, can start investing their wealth early on. Indeed, millennials were the first adaptors of robo-advisors.

The next generation of robo advisors would be able to choose an investment strategy and will be able to fluidly change between them in real time. It will be able to leverage machine learning to better optimize strategies by anticipating changing market conditions and rebalance based on realized profits, all without human interference. Currently, the most sophisticated robo-advisory platforms like Betterment or Wealthfront, are only able to recommend which of the previously input by a h uman investment strategy is best suited for an individual. They are not able to create their own investment strategy. For this reason, the most common business model is a hybrid-robo-advice, where investment managers leverage parts of the robo-advisory offering (i.e. rebalancing and asset allocation) to increase the quality and speed of their advice.

uman investment strategy is best suited for an individual. They are not able to create their own investment strategy. For this reason, the most common business model is a hybrid-robo-advice, where investment managers leverage parts of the robo-advisory offering (i.e. rebalancing and asset allocation) to increase the quality and speed of their advice.

Despite the fast growth of broadly defined robo-advisory platforms, the question on long-term value creation of this solution remains. So far it is too early to say if robos are superior to human asset allocation. Especially in its current format, using only passive exchange traded funds (ETFs) to create a comprehensive portfolio solution, it remains to be seen if it delivers superior returns (or at least protect in a downside scenario). Protecting client data, maintaining compliance and satisfying regulatory requirements all prove to be difficult for a main stream adoption of robos.

Despite these challenges, I believe robo advisors are a real threat to traditional asset managers, and will continue to spread until they become the mainstream solution. The more people start using them, the more data there will be to constantly improve the algorithms, perhaps one day showing consistent superior risk adjusted returns over a human asset allocator.

References:

- https://www.dbresearch.com/PROD/RPS_EN-PROD/PROD0000000000449125/Robo-advice_-_a_true_innovation_in_asset_managemen.pdf

- https://www2.deloitte.com/content/dam/Deloitte/de/Documents/financial-services/Deloitte-Robo-safe.pdf

- https://riabiz.com/a/2017/11/7/blackrock-may-build-the-biggest-baddest-ria-platform-yet-as-boy-wonder-begins-aladdin-izing-futureadvisor

- https://www.nerdwallet.com/blog/investing/best-robo-advisors/

- https://dailyfintech.com/2016/08/22/what-data-feeds-your-robo-advisor/

- https://www.i-scoop.eu/fintech/artificial-intelligence-big-data-manage-wealth-robo-advisers-evolution/

- https://www.luxoft.com/blog/mdillon/journeys-in-data-science-part-3-robo-advisory-the-technological-revolu/

- https://www.futureadvisor.com/