Opendoor – a new platform marketplace for home buying in the US

Overtime, different organisations and individuals have tried to create new marketplaces and platforms to deal with the many inefficiencies, frictions, high transaction costs and suboptimal outcomes that occur within the housing market each time that a home is bought or sold.

Upon studying the housing market, I found many of the key examples of market failure being exhibited in a way that leaves the industry ripe for disruption and for an entrepreneur to create a new kind of platform as a marketplace that solves for the central issues. As Alvin E. Roth explains in his 2015 book, Who gets What – and Why?, “markets with failures need market designers to step in and to create a new process by which the market can succeed, “…market designers are like firefighters who come to the rescue when a market has failed and try to redesign a marketplace, or design a new one, that will restore order.”

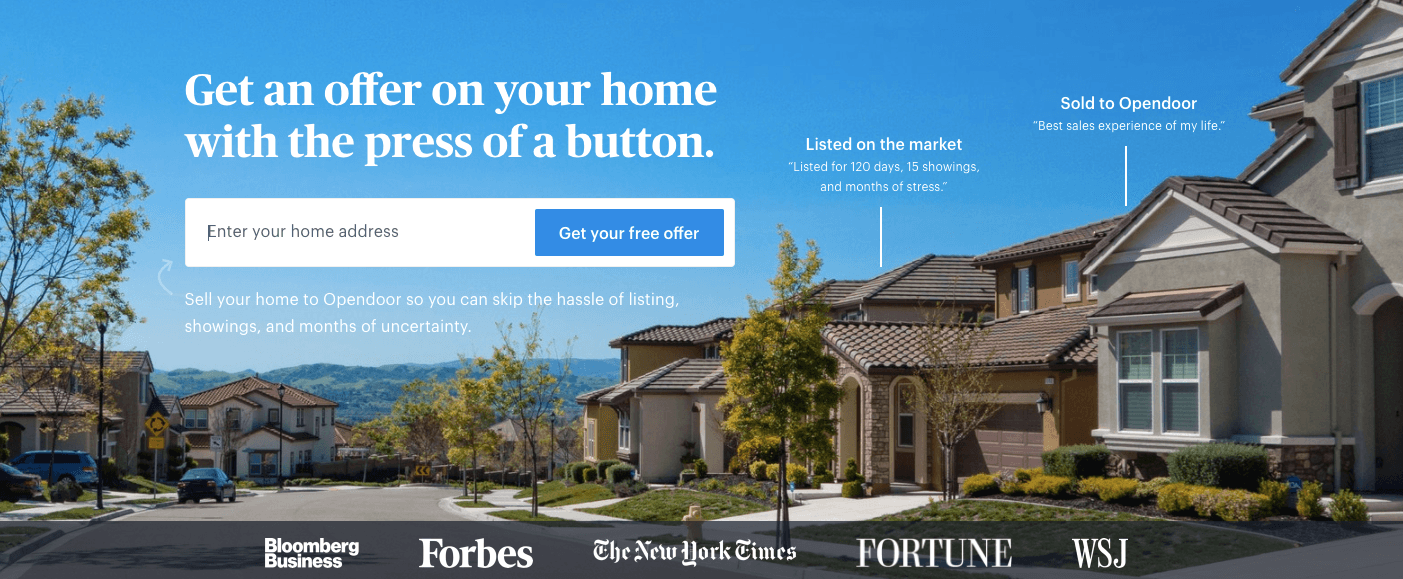

Opendoor is a San Francisco based housing platform established in 2014. The marketplace is a self-described, “online home-selling service aimed at streamlining the sales process down to a few days.” Opendoor’s key customer value proposition for the sellers is that if the seller’s home is accepted, an offer can be given and the home can be purchased within 48 hours, without there needing to be a buyer in place. The value proposition for the buyer is that Opendoor has a well assessed and ready to sell portfolio of properties from which the buyer can choose from. As Bloomberg explains, “Opendoor tries to simplify home transactions by having sellers fill out an online form and using algorithms and market data to put together an offer within 48 hours. If the homeowner accepts, the firm sends an inspector, who confirms or adjusts the offer. Opendoor then buys the home, makes repairs and puts the property back on the market.” However, for this ease of use, Opendoor adds an extra fee of 1% – 1.5%, on top of the 6% broker fee that is usually charged, and so the seller will need to decide if this additional fee is worth it, especially in the current market where there is a relatively limited supply of available listings nationwide and so finding a buyer has become easier as, for a buyer, one’s options are more limited. As Ralph McLaughlin the Chief Economist at Trulia explains, “Their success hinges on the ability to make the fee low enough to entice sellers, but high enough so that they can cover the risk of not being able to sell the house”

Opendoor mitigates the issue of information asymmetry in its markeplace by acting as the buyer for every home that comes into the platform and the seller for every home that goes out of the platform. The company is incentivised to find out the true value of the homes it is buying as it is taking on the inventory risk, with no guaranteed buyer, and therefore a micalculation in the value of a home is detrimental to the property’s resale value and the company’s ability to be able to sell it. Similarly, Opendoor’s business model only works if they are able to instil a sense of trust and credibility with the potentially buyers on the platform and the most effective way to do that is to have radical transparency surrounding the homes and the details of them.

The housing market is what is called a matching market, meaning that an individual seller has to wait for an offer to be made to her personally and that seller must accept the individual’s offer for a transaction to occur. This leads to one of the most common market failures, congestion, or synchronicity. Transactions within the market can only occur when there is a direct match between the buyer and seller and as there is no consistency to when a person might want to buy a home, “sellers may elect to keep their property on the market for months, waiting for buyers who preferences precisely match the property’s attributes and should be willing to pay higher prices.” As well, in matching markets, most players act in a sequential evaluation manner, meaning that they will only give one offer to buy a home at a time, increasing the rate of congestion in the marketplace.

Opendoor’s platform serves as an innovative solution to this problem. The Opendoor model turns the matching market into a commodity market by having Opendoor assume the role of the buyer in a commodity market for each seller, thereby mitigating the congestion created in the market due to synchronicity. Any seller may sell her house at any time, providing that she accepts the offer from Opendoor and is willing to pay the additional 1% – 1.5% fee, and any buyer has a ready portfolio of properties to choose from where, as long as she is willing to pay the sale price, there will be no waiting for another buyer.

Having raised $320M of venture funding since its founding, Opendoor is well poised to execute on the loft goals it has to transform the current housing market in the US into a marketplace based on efficiency, convenience and ease of use.

Sources:

Who gets What – and Why?, by Alvin E. Roth, Houghton Mifflin Harcourt, 2015, Page 11

https://www.crunchbase.com/organization/opendoor-2#section-overview

https://www.bloomberg.com/news/articles/2018-01-24/lennar-backs-startup-that-buys-homes-so-customers-can-trade-up

Who gets What – and Why?, by Alvin E. Roth, Houghton Mifflin Harcourt, 2015, Page 8

Making Markets, by Thomas R. Eisenmann and Scott Duke Kominers, Harvard Business School Publishing, 2018, Page 4

The fact that Opendoor is an early mover/incumbent in this space makes the business even more attractive. By nature, homeowners cannot “multi-home” (no pun intended) because they simply cannot sell their properties to another competitive after they are sold to Opendoor. Extremely high multi-homing cost + strong cross-side network effects = a winner-takes-all/winner-takes-most market where Opendoor has established the crucial early moving advantage.

Thank you for your thorough research and thoughtful analysis! Wonderful read.

Thanks, Eliza. I think Opendoor has an interesting approach to solving an obviously highly inefficient industry. I do have concerns about the additional fees – in general, I don’t think adding fees in a fee-heavy industry is going to attract many home sellers. Buyers obviously won’t mind as they aren’t paying the fees (though the sale price of homes may adjust upward to offset the incremental fees). I feel like CarMax could be an interesting player in this space if they decide to enter; houses aren’t quite like used cars, but they’ve had great success in serving as a reputable middleman in a traditionally challenging industry.

Great read, Eliza. It’s very interesting to see how data science can solve some of the frictions of these markets, but I wonder how the startup is protecting itself from some of the risks coming from external market conditions, i.e. the value of the house is not only dependent on neighborhood, number of rooms, etc. but also on the overall health of the RE market, and as we’ve seen in previous crises, that can change fast. What if they get an inflow of very motivated sellers but no potential buyers while the housing prices decrease significantly (2008 situation)? How long could they survive in that situation?

Very interesting read. Sounds like the value prop is incredibly high especially for motivated sellers who may be moving for a job, are strapped for cash, etc. and may even be motivated to sell at a lower price in exchange for the quick process. I was thinking about whether I’d sell my hypothetical house on Opendoor one day and I think my one hesitation would be that it takes away the ability to let the market decide a price and bid it up. Perhaps if Opendoor had competitors just like them that could bid for my house, I’d actually be comfortable with the model and more likely to sell. Given that it’s a winner take all market as you describe, however, it seems this may not be possible.

Great post Eliza. Their product almost seems too good to be true to solve the home buying pain points. And maybe it is. Opendoor reminds me a lot of the used car platforms like Beepi, etc. Unfortunately, I believe that many of those companies have gone out of business. I think that their primary challenge was inventory management. I am curious how Opendoor will be able to deal with this, as inventory management in the housing sector seems much more difficult than the car industry. I am curious what insurance they have in place to help them withstand downturns in the real estate market.

A really interesting read, but I do wonder how successful Opendoor will be. Firstly are the fees charge by Opendoor as well as the quick offloading of a home significant enough to offset the lower price offered to the seller vs a normal selling process. Given that a home tends to be the store of a significant percent of an individuals net-worth, I find it hard to imagine use cases where sellers would prefer time vs more money in a transaction of this magnitude.

It would also be interesting to see how Opendoor would manage its inventory in the case of downturn, where their inventory turns would slow down. Given the venture backed funding, I presume there is a high cost of capital and the need for significant growth, which seems to be at odds with the high working capital nature of this business and risk of significant impairment in inventory.

Thanks for writing about this, Eliza! I think the Opendoor model is really interesting, and a few of us actually visited the company on Westrek last year. Like you say, there appears to be pretty meaningful value for sellers – the speed and certainty of closing on a house sale, for many people, is well worth the added commission cost to Opendoor. Based on notes I wrote down during our meeting, it sounds like they make 40% gross margin per transaction, and they focus on houses in the $150-500K value range.

There are, however, several key risks to this business model. The first is the inventory risk that others have alluded to – in the event that Opendoor cannot find a liquid market to sell the house they’ve just purchased, they incur inventory carrying costs, which include maintenance and probably most significantly financing cost. This financing cost is the second risk that Opendoor incurs, namely that they lever up meaningfully to purchase these homes and are left paying the interest on that debt. Extended holding periods / reduced turns certainly increases this holding cost, but so does potential changes in the rate environment – with interest rates at all time lows and only expected to go up, Opendoor’s cost of holding inventory should also go up (and compress their gross margins). A third risk is macro housing valuation risk. By holding onto the inventory Opendoor holds all the risk associated with home values, both on the upside and the downside. Depending on the macro environment, Opendoor’s leverage profile coupled with rising rates and decreasing home prices could spell significant trouble for the company. To manage all of these risks, they attempt to use data algorithms that compute value-at-risk for the home portfolio and build in some margin of safety. In theory, this should help them manage risk, but one thing to watch out for is that all the CDS algorithms in 2008 were supposed to manage risk as well, and we all know how that turned out.

So I’m a property-owner and have spent a LOT of time with property managers. I think OpenDoor is a super interesting prospect and I agree there are industries that are ripe for market makers. However, real estate is a strange one that has continued to be the exception to many rules. The big issue is that real estate is so fragmented. It’s going to be very difficult to standardize how you work with sellers to understand their properties better. You can send someone to inspect, but that part of the process is no different than it is now and is the most pivotal and important role. In one visit, no one is able to see inside the walls appropriately enough to properly value a home. The arbitrage in this is where people make their money in mature markets, so trying to take on these huge assets without appropriate analysis is a giant risk. I agree that the incentives of OpenDoor are to get the valuation right, but their incentives are also to keep the renovations CHEAP and fast, and I mean real cheap to the point of risking how much value are they adding into a given real estate market. If they make cheap renovations, say goodbye to consumer trust and their whole platform breaks down. Additionally, the broker fees are often to the buyer not the seller so why would a seller care about the added fee? Your buyer does, and theres your fee problem. I think calling it just a matching problem is trivializing how much variance there is in taste, WTP, different city markets…etc.

The reason the housing market is so crazy is not cause someone hasn’t been smart enough to aggregate properties (lots of websites do this) or own the properties (literally what property developers do) its that the variance in quality and renovation is so high that it nets out the economies of scale that a website offers. Additionally, with the internet of things movement coming most houses will start to self-detect maintenance issues which will completely commoditize the “valuation” industry and increase the transaction speed; so OpenDoor’s value proposition is not very future proof. If I was going to invest even a small portion of $320M into a business I’d like to know they will be around in a dozen years or two even if they do “win” in some markets.