One Medical Group: The Potential Uber of Healthcare

As the on-demand economy begins to disrupt healthcare, One Medical Group is best positioned to lead the booming market of on-demand primary care

As Uber and Lyft have transformed the transportation industry led by technology, startups are quickly transforming our healthcare system with technology in order to be more on-demand and to reduce required time in a medical facility. The investment focus on on-demand healthcare is enormous, as Accenture estimates $1Bn in venture capital investments will go to on-demand healthcare this year. Additionally, the United States has a shortage of primary care doctors, while demand is soaring. Out of several competitors, one stands above the rest as best positioned to dominate the tech-enabled primary care and capture the benefits of the two trends cited above, combining a strong mobile offering with high-end physical primary care locations that reduce cost while offering a wide variety of services.

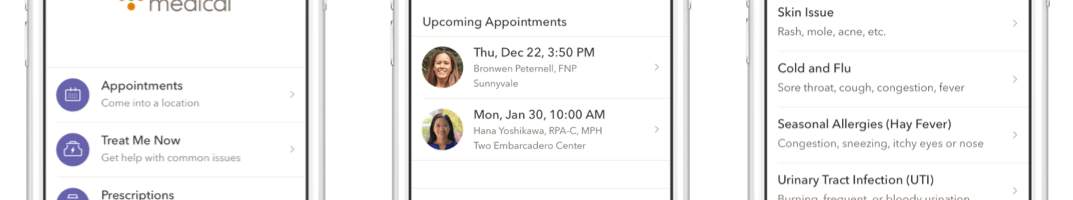

One Medical Group is the national leader of technology-enabled primary care currently and is well-positioned to continue leading the market by taking advantage of being the first-mover and as a result has more physical locations and more funding than other startups in the space. One Medical offers high-end primary care facilities combined with a mobile app that allows for booking same-day appointments and mobile treatment of patient’s needs. In addition to paying a co-pay for insurance, One Medical charges its customers a $150-$200 annual membership fee to access all locations. While providing value through high-quality offices and on-demand service in the mobile app, One Medical is also able to reduce its operating costs; CEO Tome Lee disclosed that the company’s technology provides “10x the service at about a third of the labor cost” for primary care. This efficiency allows the company to scale more quickly even though it has physical locations. Beyond providing value to patients, One Medical is also highly appealing to physicians, as the mobile technology allows frequent touch points with patients. An important reason cited for a shortage of primary care physicians in the U.S. is that they are burned out and frustrated about the limited time with patients and lack of ability to see progress. Thus, One Medical is able to offer strong value to both sides of its platform to build scale more quickly.

(Photo of a One Medical Group location)

(Photo of a One Medical Group location)

One Medical has the ability to continue dominating this growing market as a result of being first in the space and by focusing both on technology and physical locations. With $180 million in funding to date, One Medical is one of the most funded on-demand companies in history, allowing the company to invest in its mobile technology and open more physical locations. With 50 locations in seven U.S. markets, One Medical has more location than any competitor currently, including Iora Health and Forward. Moreover, by having physical locations that offer important services such as blood testing, One Medical has significant competitive advantages over telemedicine providers such as TelaDoc and American Well that do not offer physical locations. That does not mean that competitive threats are weak, technological advancements in mobile healthcare offerings will continue to be the driver of more value creation and consumers will seek out companies that can offer the widest variety and highest quality of mobile healthcare offerings to reduce the time needed in a doctor’s office. One Medical will need to continue to invest in its technology and expand the health-related services provided in its mobile app to stay ahead of the competition, which it is well positioned to do with the most funding and greatest number of physical locations across the U.S.

Great post – I wonder to what extent the value proposition of the One Medical model has led “traditional” PCP operators to become more technologically-enabled. At some point, customers in areas served by one medical could demand the level of service offered by the company- could this bring the end of the independent PCP? Could acquiring or partnering with independent PCP providers (versus starting new sites) be the next wave of growth for One Medical?

Very interesting idea! I definitely believe One Medical and companies similar to it will bring an end to independent PCP eventually. Indeed some competitors in the space do partner with independent PCP providers rather than building their own offices. However, I would be surprised if One Medical pursued this path. They have very strict standards for their offices and they are all uniformly the same. Rather than expand via existing independent PCP providers, I believe One Medical will continue to expand their digital offering and focus on that first before really making a large push into many more physical locations. But I believe you could be right about that someday.

Thanks for your post! I believe on-demand or concierge medicine is on the rise in America with companies like Pager and Heal. I wonder what regulatory challenges on reimbursement for services since care is provided remotely as well as concerns about patient data privacy.

Interesting point! Thank you. The beauty of providing software to patients to help treat ailments is that it doesn’t cost the provider any more as incremental people use the service. Thus, I don’t think there will be many charges or needs for reimbursement for digital services that companies like One Medical provide. However, I do believe you are right where that could be an issue in on-demand telemedicine, where the only services provided are digital. Indeed data privacy is an immense concern for patients and providers alike, which is why having a strong technology platform is essential for companies such as One Medical.

Thank you for your post as it described a platform where it seems that both providers and users are indeed winners delivering a critical service to our society. The one area that I would be interested to see how One Medical Group is responding to is older patients or “seniors”. Definitively a fast growing segment of the population in the US and in many other parts of the world, with increasing life expectancy, consuming greater healthcare services than the generations prior and yet, often, a population segment which has a large proportion of disengagement toward digital interaction.

How does a business model such as One Medical Group address this target?

Appreciate your comment! I do not believe One Medical is focused on older patients at this time. For one, utilizing the company’s mobile app is essential for accessing all of its services, which is likely more challenging for older patients. Although you are right that older patients are are large segment that requires medical care, I believe One Medical takes the approach that targeting younger people will result in customers that they will acquire for most of their adult lives, and then lock them in as they become older patients.