Nest: Falling Into The Chasm

Nest, thought of as being on the forefront of the Smart Home, has been struggling to cross the chasm and gain mass consumer adoption. Can the company rethink its strategy to deliver consumer value?

In 2014 Nest Labs had it all. The darling of Silicon Valley, the Smart Home technology company was forecasted to have over 1 million users, selling $200-300 million in revenue and was acquired by Google for $3.2 billion.[1] Founded in 2010 by two former Apple engineers, Nest was at the forefront of the “internet of things” (IoT). Yet, four years after being acquired, Nest has failed to meet revenue expectations, with rumors that its 2015 revenue was only $340 million, far below both Google and Wall Street targets.[2] This post will explore why Nest has stumbled and how its story represents the challenges facing the entire Smart Home market.

The Smart Home Market:

A Smart Home device can be defined as “any stand-alone object found in the home that is connected to the internet, can be either monitored or controlled from a remote location, and has a noncomputing primary function.” The market encompasses any smart appliance, smart home security and smart home energy product. A 2015 Business Insider Intelligence report estimates the total addressable market to be 13 billion devices by 2020, yet the same report forecasts that only 193 million Smart Home devices will ship in 2020, which is just an 18% CAGR from the 83 million shipped in 2015.[3]

Nest: Failing To Offer A Compelling Consumer Value Proposition

On the surface, the value Nest is creating for consumers seems simple: an elegantly-designed thermostat controlled by your smartphone that adopts to your unique behavior to optimize heating and cooling, ultimately saving energy for your home. To a certain set of early adopters this is absolutely true. These consumers tend to be tech-savvy, high-income and see the value in having a smart device even if their non-smart thermostat is working perfectly. [3]

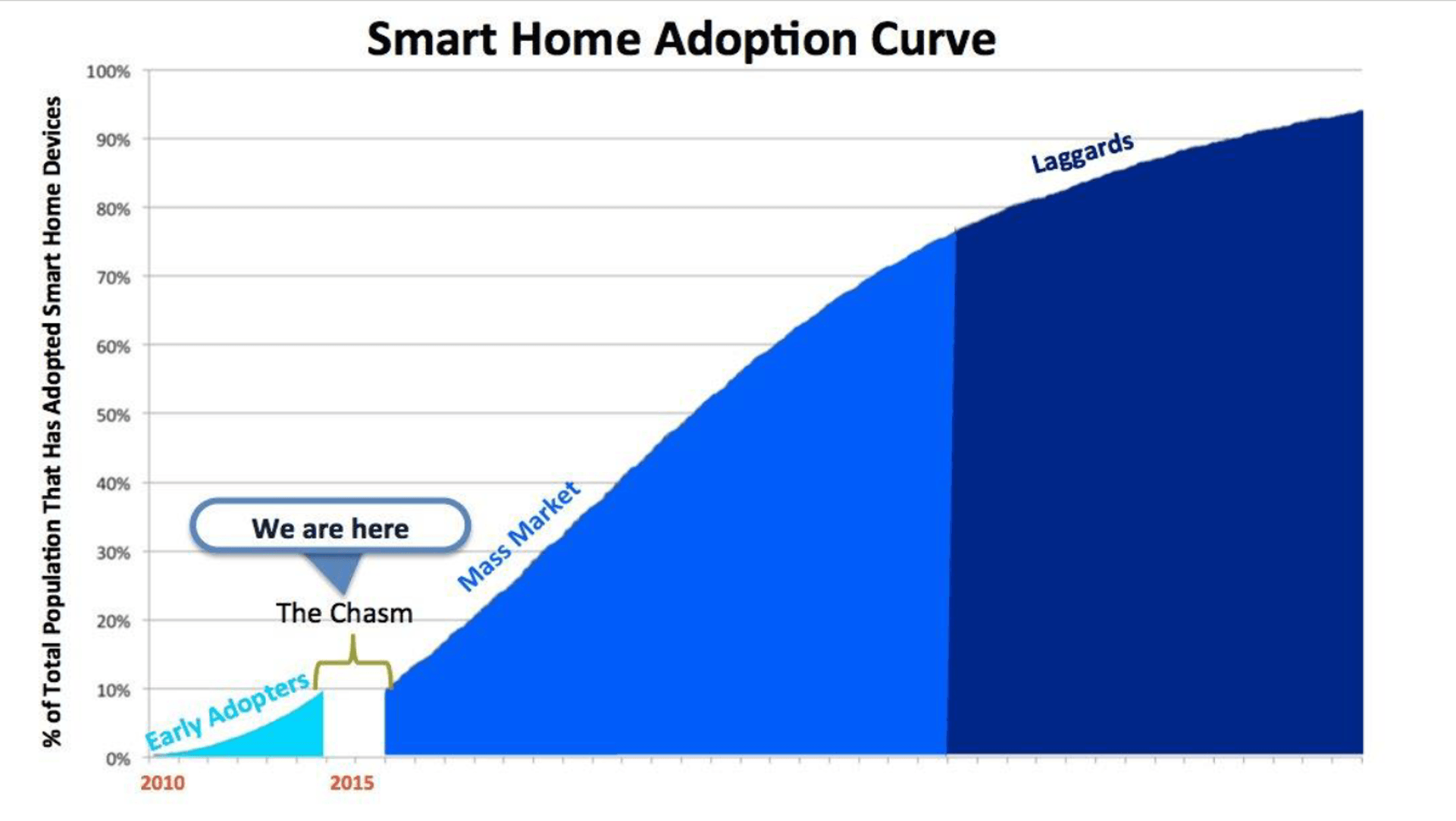

Yet, a market of early adopters does not make a technology “winner.” What Nest has failed to understand is the importance of “crossing the chasm” in the technology adoption life cycle curve. Moore’s Chasm says that there is a gap between Innovators/Early Adopters and the Early Majority/Mass Market in how they view technological products. While the Early Adopter is looking for change between old and new ways and will easily accept bugs that accompany innovation, the Early Majority consumer is a pragmatist looking to minimize discontinuity – they want evolution not revolution and need a clear and compelling reason to buy. Technologies that fail to adapt their product and marketing efforts to prove its need to this distinct consumer segment will fail to become widely adopted technologies – think of Segways or QR Codes.[4]

As the below graph indicates, Smart Home devices, including Nest, are currently in the chasm of the adoption curve [3]:

Nest is not well positioned to cross the chasm for several reasons:

- Premium Pricing: There is a large price gap between a basic thermostat (~$20) and Nest, priced at $249. The higher the price differential, the harder the sell will be for why a pragmatist consumer should switch.

- No Clear Painpoint: Complexity is not a friend on the adoption curve. The more complex the benefit of your product is, the harder it will be to convince the pragmatist consumer to spend more money and switch over to something they do not understand. Nest suffers here, because on top of a complicated installation system, its energy saving/smart message is not easily communicated. The below in-store display at Home Depot needs 3 panels of information to try and sell Smart Home products (including Nest) to its consumers.

- Long replacement cycle: Thermostats do not need to be replaced that often, so the pragmatist consumer is rarely in the consideration phase, in which they would actively look for reviews and information about new thermostat technologies.

- Technological Fragmentation: The ideal for a pragmatist consumer is to have an entire ecosystem of connected products for the Smart Home category that all work seamlessly together. And while Nest has introduced some additional products (a smoke + CO alarm and security cameras) there are still a wide variety of competitors offering different products both in Nest’s spaces as well in other Smart Home products. No standard has been created as of yet, which adds costs and creates more complexity for the consumer.

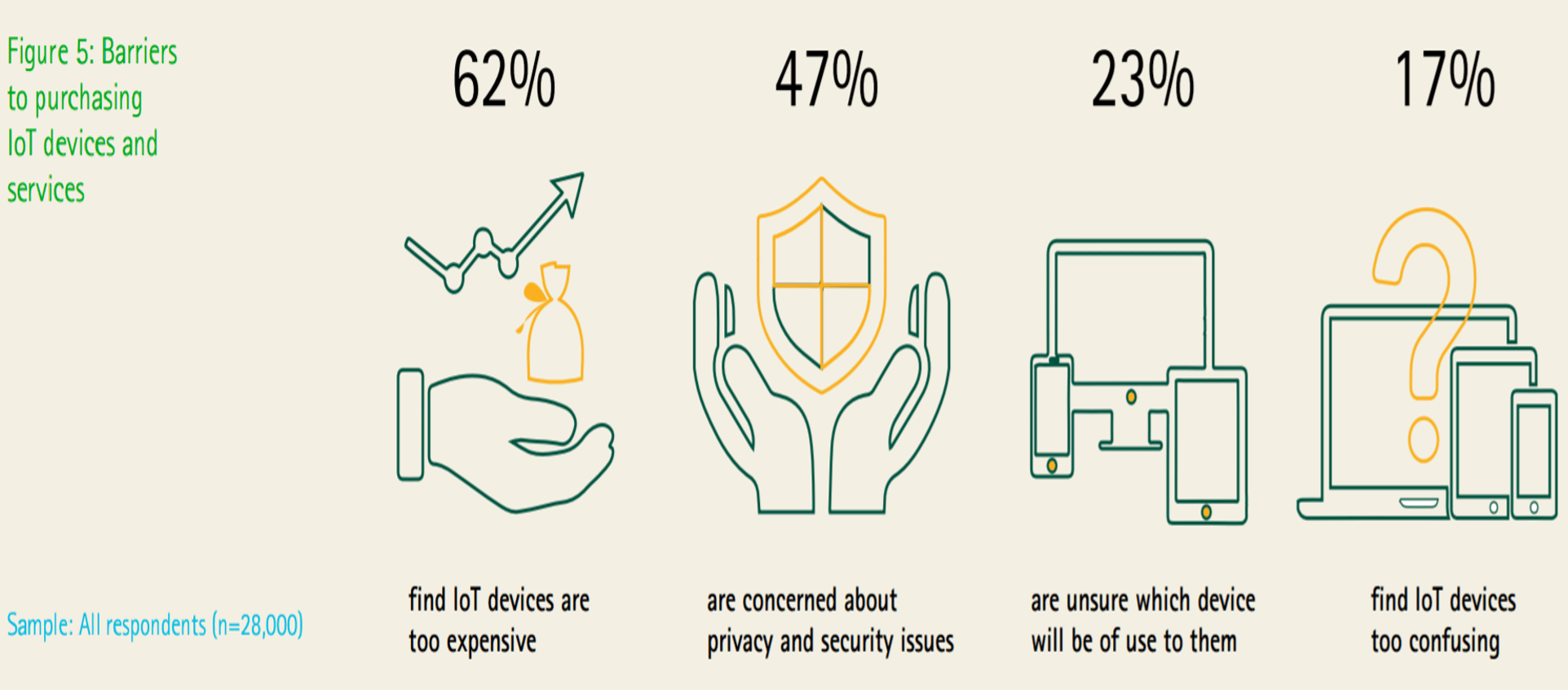

These barriers are not just for Nest alone, an Accenture study in 2016 highlights that IoT technology as a whole is seeing many barriers to demonstrating value perception:[5]

Although chasm effects are likely not the only reason Nest’s sales are stagnant (another blog post could be written about acquisition challenges within Google), it is important to recognize the difficulty of gaining mass market adoption. A company must adopt new strategies just at the time they have become comfortable with old ones. While Nest is losing the technology adoption battle right now, it is at a crossroads. With its founder/CEO stepping down in 2016, Nest has the opportunity to rethink its adoption strategy and to try to win in the Smart Homes battle. For example, the company is already examining a change in its business model from B2C to B2B through targeting professional installers and contractors.

[1] http://www.forbes.com/sites/markrogowsky/2014/01/14/5-reasons-nest-sold-to-google/#393ea6dc65bc

[2] http://www.vanityfair.com/news/2016/03/nest-googles-dollar3-billion-bet-may-be-in-trouble

[3] Business Insider Intelligence, “The US Smart Phone Market Report”, September 23, 2015

[4] Crossing The Chasm 3rd Edition, Geoffrey A. Moore, 2014

[5] https://www.accenture.com/_acnmedia/PDF-3/Accenture-Igniting-Growth-in-Consumer-Technology.pdf#zoom=50

Really interesting post, thank you for writing it. I’m curious about the extent to which the lack of strong network effects for Nest (and for the IoT space more broadly) will lead to a highly competitive and unprofitable market. Specifically, the proliferation of “smart” devices and the subsequent commoditization of data as its collected by many players, the future does indeed seem bleak for Nest! What will “winning the Smart Home battle” look like? And of course, security is a huge concern, as you’ve mentioned

This really gives me something to think about with regards to crossing the chasm in the Smart Home market at large. B2B is an interesting idea for Nest but I think until they get their prices down they’ll have trouble convincing cost-conscious contractors to install them. I wonder if the answer is a change in business model to SaaS or more outcomes based which would appeal to a hotel operator or building manager. I also wonder if the introduction of Google Home may be able to pull in more customers as platforms such as that one and Alexa start managing everything in a customers’ house.

Excellent post— Price, no clear pain point, long replacement cycle, and technological fragmentation… I think these are all great reasons why Nest is having difficulties crossing the chasm. But I really wonder how much of Nest’s problems is attributed to the above versus its go-to-market strategy. You alluded to this at the end of your post, so it will be interesting to see what changes the company makes.

I just remember seeing these thermostats all too well in the store and advertised everywhere on TV. I think Google really went all out in pitching the product to consumers! But, as you had mentioned, there’s not really a pain point for thermostats – I can’t think of ANYONE who has ever thought, “yeah, I need to replace my THERMOSTAT some day”. So, to me, it seemed like a waste of dollars for Google to market to customers in the first place. My first instinct would be to target first home buyers; since this is such a niche market, I don’t see why you wouldn’t want to go B2B.

Of course, hindsight is always 20 / 20. I just wonder what Google’s thought process really was when they decided to advertise Nest like crazy. Surely they didn’t think mass market adopters would fly out of their homes for these things… (or did they?) 🙂

Nice post, thank you for sharing. Value for money is for sure an important, perhaps the most critical, consideration for mass market to adopt a new product. It’s not only a question for Nest, like you said, all smart home devices will need to answer the same question: how much do my target customers value the delta between their smart and stupid home brought by the device. In addition, we see different players are betting on different devices to function as a hub to connect the device system at home, and I don’t think thermostat is a good choice in that sense due to the fact that it is not a necessity and has a long replacement cycle.

Thanks for this Cassie. Sad to see Nest adoption hasn’t picked up since it was one of the first IoT devices that got a ton of PR, etc. back in the day. Sounds like price is the main issue here for the average consumer. Given that Google owns Nest, wonder whether there’s a “loss leader” play where Google sells it at a loss but in return, gets data from the customer, which it can add to what it knows about you already and monetize via advertisers or other partners (heaters w/less energy consumption, home insulation products…?). However since Nest only controls temperature data, the value of that data may be insignificant. Do you have thoughts on the subsidy-by-giving-away-personal-data model?

Its marketing messaging also appears problematic. Do you think Nest could come up with a simple and compelling cost savings or save-the-earth messaging? I’ve definitely accidentally left heating on while out of the house and gotten hit with massive energy bills ($100+ for the month!) so I can see myself being convinced to get one.

Thanks for this post! I think you’re spot on with the reasons why mass adoption is being hindered – with price being a key concern. However, this seems to be a chicken and egg problem. It is likely difficult for most new technologies to reduce their price until they can sell them at high volumes, and yet they need to reduce the price in order to generate enough demand. I guess Google is in a position to take the P&L hit and be a “loss leader” as Chun mentioned, but it could be brand dilutive for Nest to slash prices just yet.