‘Just Do it’ with innovation!

Nike paces ahead with speed-to-market and direct-to-customer focus along with close attention to personalization and customization when it comes to product innovation. Will it win the race?

Innovation is part & parcel of a B2C retail company, however, digital innovation has accelerated helped differentiate winners and losers even further. The same remains true for athletic footwear brands.

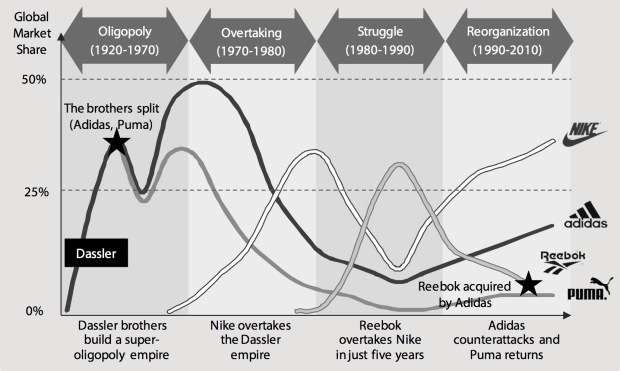

Though the industry started as an oligopoly with Adidas leading the market, over the years Nike has established itself as the fore-front runner (pun intended). Through its focus on innovation in design, manufacturing, distribution and marketing it has continued to focus on the entire end to end process and continue to grow.

History: Leaving Adidas behind

Adidas first added its iconic 3-stripe logo following the 1952 Summer Olympics and moved the production of the company offshores to Asia around 1989 after being bought by French Bernard Tapid. Nike was founded by Phil Knight and Bill Bowerman in 1964. The iconic “Swoosh” was first used on Nike shoes in 1971 and the “Just-Do-It” ad ran during a campaign in 1988, often coined as one of the top five ad slogans of the 20th century.

Even until 2004, Nike had a market capitalization of $7.0 Billion dollars and Adidas’s market capitalization was at $6.8 Billion dollars. With time, Nike’s effective and aggressive marketing, focus on operational excellence along with continued innovation in its products played in its favour.[1]

Future: Supporting global trends

The growing demand for sports, the embrace of active lifestyles, and demographic changes are tailwinds for our business. The market is expected to grow annually by 9.0% (CAGR 2019-2021).[2]

In the 2018 letter to shareholders, Nike states, “People everywhere want to lead healthier lives; in fact, between the U.S. and China, over 500 million people are active at least once a week. On the heels of a thrilling World Cup, and with the NBA’s growing global popularity, passion for sport is surging. Meanwhile, streaming and social media are changing the way we consume sport content—bringing billions of consumers closer to the leagues and athletes they love. And over two billion digital natives in markets like China, India, and Latin America will join the middle class by 2030.”[3]

What makes Nike the winner?

Value creation

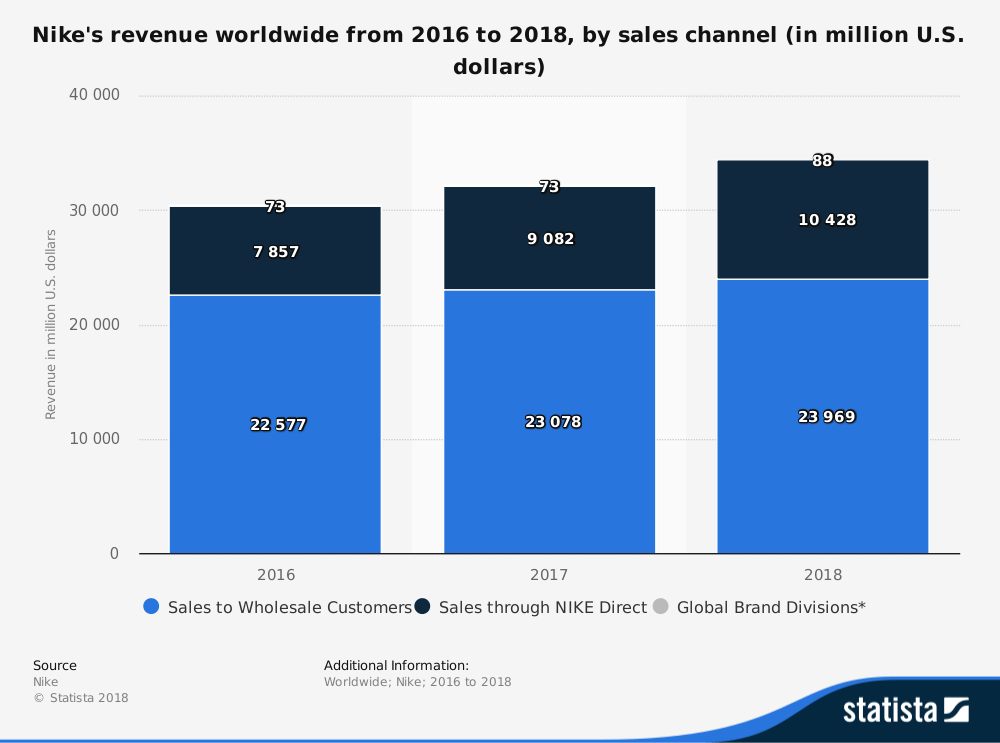

In 2019, Nike launched a new strategy called “Consumer Direct Offense,” which focuses on speeding up the pace of product innovation, speed-to-market, and focuses on increasing direct customer engagement. This investment is supported by the growing direct B2C sales growth as shown below.

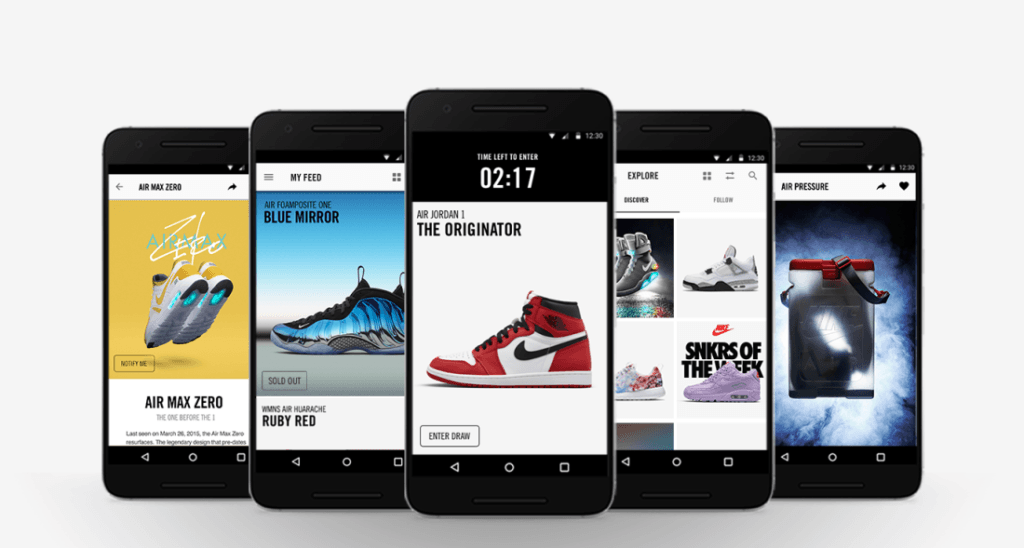

- SNKRS: Nike is focused on leveraging this app for product launches, product reservations and additional features like scanning products for additional information and skipping lines with self-checkout. Over 100 million Nike customers have signed on so far for the Nike app and the company aims to triple that number by 2023 [4]

- Nike Live: Nike is using data and analytics for choosing store locations and assortments based on local demand. To amplify sales through its wholesale distribution channels, Nike has identified only 40 retail partners, both online e-commerce players and physical retailers, that offer the best access to the customers it targets and who can deliver best-practices customer experience for the brand.[4]

- Express Lane: Nike is digitizing its end to end supply chain. Express lane allows for product updates such as materials and colors for popular models based on real-time consumer insights, and restocks stores in as fast as two days.[3]

- Continued product innovation: Nike is focused on meeting the customer expectations on customization and personalization. This is why Nike announced that it had acquired Zodiac, a consumer data and analytics company. Nike’s Adopt BB (BB standing for basketball) can actively alter its shape, connects to your smartphone of choice via Bluetooth and collects an unprecedented amount of data about human movement, akin to what Nike collects in its own internal Performance Lab, surpassing anything close to Nike+ did. [5][8]

Value capture

Nike uses its innovation focused strategy for adding new members, heightening engagement, and improving conversion which fuels its sales growth. Express Lane is leading to stronger full-price sell-through rates and efficient supply chain management. While trying to boost its own direct online sales, Nike is also bowing to the inevitable by making select footwear models also available through Amazon.

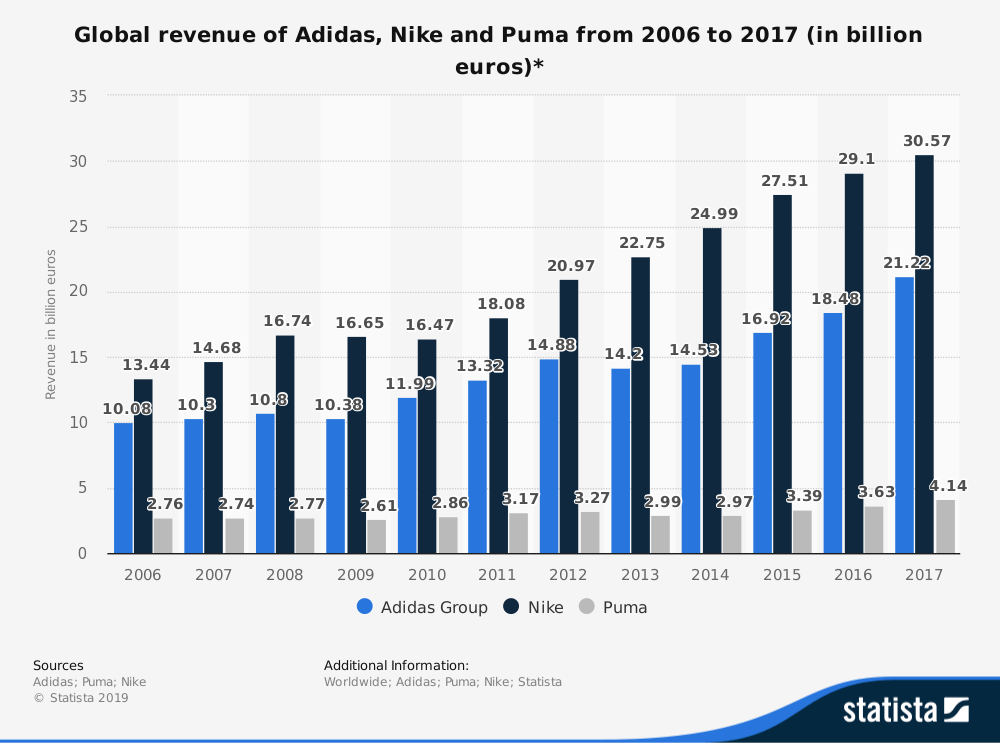

Additionally, Nike focuses on design thinking, prototyping and early corporate buy-in. For example – it took 195 trials before Flyknit Racer was created. Nike Flyknit, yarns and fabric variations are precisely engineered only where they are needed for a featherweight, formfitting and virtually seamless upper. CEO Mike Parker is well known for his focus on innovation.The statistic below shows a revenue comparison of the sporting goods companies Nike, Adidas and Puma from 2006 to 2017.[6]

Losers

Multi-brand Retailers

The warning here is that brands like customers can leave, especially for brick and mortar retailers. If they don’t move fast enough to innovate and differentiate themselves to offer value to both shoppers and to the power brands they risk their survival. Nike’s CEO considers the mediocre retail market too unstable to rely on.

Adidas, Puma and others

For the sportswear industry, Nike is opening a new front for competition in sportswear: the best retail experience. Its competitors will have to catch up to meet the standards that Nike is setting when it comes to physical and digital retail through its own and partner channels.”[4]

Additionally, major brands like Adidas need to keep up not just with the product innovation but also speed-to-market especially in the lifestyle category. While Adidas unveiled its 3D-printed offering in 2016, Nike claims it is the first in the world to introduce shoes that has the uppers (the top part of the trainer normally made from fabric) utilize this technology. Adidas was still making sock sneakers in 100 different varieties, even if the market had long moved beyond them. The brand started to produce 3D and 4D-printed soles, but weren’t able to make them at a mass level and hence, the idea never registered at a mainstream level. [7]

What’s next?

Technology has clearly helped Nike boost its standing. To continue to be a winner, a shoe needs to go beyond celebrity endorsements and marketing. The products must take the technology a step further while fitting the lifestyles of shoppers.

Given Nike’s emphasis on innovation, I wouldn’t be surprised if it doesn’t continue to lead in the race.

References:

[1] Quartz, “Nike’s multi-billion-dollar empire is built on air”,https://qz.com/936931/nike-air-vapormax-as-air-max-turns-30-the-sneaker-giant-bets-big-on-its-next-generation//, Accessed 4 Mar 2019

[2] Footwear Worldwide, Statista – The Statistics Portal, Statista, https://www.statista.com/outlook/11000000/100/footwear/worldwide, Accessed 4 Mar 2019

[3] Nike, 2018: Letter to Shareholders, https://s1.q4cdn.com/806093406/files/doc_financials/2018/ar/mark_parker_letter.html, Accessed 4 Mar 2019

[4] Forbes.com, “Nike’s New Consumer Experience Distribution Strategy Hits The Ground Running”, Pamela N. Danziger, Dec 2018, https://www.forbes.com/sites/pamdanziger/2018/12/01/nikes-new-consumer-experience-distribution-strategy-hits-the-ground-running/#4a1c730bf1d0, Accessed 4 Mar 2019

[5] Fast Company, “Nike’s big bet on the future of connected shoes”, https://www.fastcompany.com/90291303/nikes-big-bet-on-the-future-of-connected-shoes, Accessed 4 Mar 2019

[6] Adidas, and Puma, and Nike. “Global Revenue of Adidas, Nike and Puma from 2006 to 2017 (in Billion Euros)*.” Statista – The Statistics Portal, Statista, www.statista.com/statistics/269599/net-sales-of-adidas-and-puma-worldwide/, Accessed 4 Mar 2019

[7] Complex.com, “What the Hell Happened to Adidas in 2018?”, Matt Welty, Dec 2018, https://www.complex.com/sneakers/2018/12/what-the-hell-happened-to-adidas-in-2018, Accessed 4 Mar 2019

[8] Nike. “Nike’s Revenue Worldwide from 2016 to 2018, by Sales Channel (in Million U.S. Dollars).” Statista – The Statistics Portal, Statista, www.statista.com/statistics/888725/nikes-revenue-by-sales-channel-worldwide/, Accessed 4 Mar 2019

I agree that Nike has been able to embrace digital technology much faster than its main competitors including Adidas, Puma, etc. However, you don’t see any thread from other competitors including Under Armour, Lululemon, among others. Finally, do you know the sales of Nike in its different sales channel? (Stores, Wholesales, Online, etc.)?

Thanks for the post! I found the SNKRs portion of your write-up to be particularly interesting – in particular, the fact that the company aims to achieve 300M users by 2023.

From my understanding, the SNKRS app is attempting to recreate the sneakerhead experience, in terms of exclusivity and achievement (in terms of getting access to an in-demand pair of shoes). Yet, at the same time, the app tries to provide a level of “meritocracy” in terms of any particular user might have a chance to buy an exclusive drop. An interesting wrinkle to this dynamic is that, as the user base grows, both the exclusivity and the achievement provided by the app decrease (i.e., more people will be buying formerly “exclusive” drops and it will be harder to achieve access to the drops you want, due to more competition).

While this is an impediment to the growth of this platform, it might actually be beneficial to Nike in the long-run, as it will not anger their existing (and much larger) channel partners, which I believe will continue to be very important to Nike in the future.

Clearly multi-brand and department stores are being one of the losers of this shift. But now the question for Nike will be what strategic path to take in the Amazon world that we are all living. There is a natural trade-off between the value creation that Nike is generating with all these innovations and the value capture part, being a world class manufacturer in an e-commerce world dominated by Amazon. For many years Nike said that they will not sale on Amazon,and Nike tried to develop a strong own eCommerce chanel. But this just changed few months ago when both companies reached to a partnership agreement. If Nike is who is creating the value trough innovations, they will aim to capture that value trough their own website or retail stores and not share any of the “pie” with Amazon. As Nike start selling on Amazon, and start capturing sales volume, Amazon will have more power on Nike and will start capturing more and more of the value that Nike will create.