Florida Power and Light: Disrupted by Data

Florida Power and Light is under attack by a wide range of digital innovations. By embracing this digital transformation utilities like FPL have the chance to control the energy ecosystem into the future, but if they don’t fast they could face a vicious downward spiral.

Florida Power and Light (FPL) is the largest utility in Florida. FPL, along with the entire utility industry, is at the brink of disruption as the energy industry transforms at an unprecedented pace, driven by technology, data, and the internet.

FPL is a vertically integrated, regulated monopoly that generates and delivers electricity to its customers. Historically FPL’s core business has been generating, distributing, and selling electricity with large assets. Utilities invest in these capital-intensive, large generating assets, and were historically guaranteed a healthy rate of return through electricity customer payments that were set by regulators. However, this business model is threatened by concurrent waves of technology-driven change in the energy industry. The primary disruptions are provided below:

- New distributed energy resources (solar, storage) that make the grid more difficult to optimize and reduce customer reliance on FPL (and thus reduce revenue)

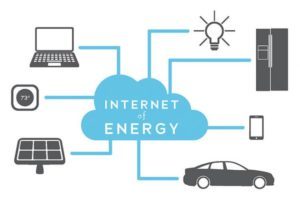

- Home energy management platforms, energy IoT, and “energy internet” create data management complexities and also encourage reduces customer dependence on FPL.

- Challenges handling bi-direction flow of electricity as solar panel owners try to push their energy back on to the grid.

- Proliferation of electric vehicles change the grid load and make it more difficult to manage

With the “internet of energy,” a term created to describe the data-drive technological advancements in the utility industry, the electricity infrastructure is more complex and dynamic with multi-directional flows and millions of data points. The grid is becoming more difficult for the utility to manage, and the data flow is becoming equally as important as the electron flow in achieving more efficient and resilient electricity grids. These technological advancements are also opening FPL’s service territory to third parties who are stealing market share from FPL’s monopoly. The “performance defining component” of the electricity grid is shifting from hardware to software, and utilities might not be equipped to win in this arena.

However, there is still a question about who is best suited for long-term management and ownership or new energy assets in the rapidly evolving ecosystem. There is no clear 3rd party winner yet. According to Bloomberg research, utilities and energy companies in the sector are investing $590 billion into digital initiatives between 2017 and 2025, equivalent to one fifth of all their projected capital investments. FPL embraces this as an opportunity, rather than a threat, there is a huge opportunity for FPL to become utility of the future. If FPL fails to act they could see their revenues decline as customers no longer need to rely on them for grid power.

Organizational Challenges

- Threat-Opportunity Framing. It is imperative that FPL views the new energy paradigm as an opportunity, not a threat. Many of the shifts in the energy industry fundamentally challenge FPL’s core identity – proving safe, affordable, reliable electricity at scale – and threaten to erode FPL’s customer base and revenues. FPL has monopoly power, so it would be and easy for them to lobby for regulations and implement new rate tariffs aimed to block the proliferation of new technology and protect its current business. However, this is not a long-term solution. Instead, now that the energy internet threat has the attention of high-level executives, they should reframe it as an opportunity and dedicate resources towards building new business around the energy internet.

- Assets and Processes. FPL’s assets and processes revolve around delivering reliable and safe energy to their customers efficiently and cost effectively. They have become deeply ingrained over the last 93 years. Transforming into the utility of the future will require significantly different resources and processes. For example, today FPL’s resources are large power plants and transmission lines, but with the internet of energy assets will primarily be small distributed energy resources, software, and big data. FPLs processes are currently formal and rigid to ensure 100% safety and reliability but, in the future, processes must emphasize speed and agility. As discussed below, FPL can acquire a company with the desired resources and processes and slowly integrate the core company into the new processes.

- Legacy IT Systems. FPL is skilled at using real-time data to optimize the grid and provide reliable electricity supply, a remarkable accomplishment. However, in general FPL’s IT and data systems are clunky and antiquated. There are dozens of different systems across the organization that aren’t integrated, are not user-friendly, and don’t have the functionality expected in the digital age. It will be a major challenge to upgrade the IT systems across the organization. This must get executive attention

- Siloed Organizational Structure. In addition, FPL is siloed (Energy development, regulatory, power delivery, construction, supply chain, etc). Each silo has its own distinct culture, and collaboration across boundaries is often strained. In the future, data will need to flow freely across teams to remain agile in the age of the energy internet. Employees could rotate across teams to help break down barriers, and there could be cross functional task forces.

Opportunities

FPL could look to broaden away from its core business of generating and distributing electricity at scale and could also serve enhance its software capabilities to control the new “energy internet.” FPL is potentially well positioned to win in this space for the following reasons:

- Forward-Thinking Leadership. The CEO of NextEra (FPL’s parent company) is an HBS graduate who is very forward thinking. He is constantly challenging employees across the organization to imagine what the industry will look like in 30 years and how to shape that future in NextEra’s favor. In addition, the CEO values creative, innovative managers willing to take risks and drive change.

- Crowdsourcing from Employees. FPL could leverage it’s engaged employees to crowdsource ways to innovate around the digital transformation. FPL currently has a program called “Project Accelerate” to get employee ideas on increasing revenues or decreasing costs. Project Accelerate has been tremendously successful to date, with projected improvement in the bottom line of $425M by 2020. FPL could build on this foundation and crowdsource ideas specifically around digital transformation.

- Funding for Acquisitions FPL has a strong balance sheet and excellent credit score, meaning that they are well positioned to acquire a leading third-party Internet of Energy company, such as AutoGrid. Do to the different business models, resources, and processes of a regulated utility and a young software technology company like AutoGrid, FPL should keep the company separate from the rest of the organization and foster its growth and development. They can then slowly integrate the technology culture throughout the rest of the organization.

The good news is that FPL is aware of the disruptions surrounding them, and rather than fighting these disruptions through regulations and tariffs FPL is starting to view them as an opportunity for continued growth. I hope that FPL is able to embrace digital transformation, overcome organizational challenges and become the utility of the future.

Sources

Hirtenstein, Anna, UC. Albanese, B. Parkin. 2018. Utilities Plot a Digital Future—And Look Like Tech Stocks. Bloomberg Businessweek. https://www.bloomberg.com/news/articles/2018-03-06/utilities-look-more-like-tech-stocks-as-they-plan-a-digital-futur

Investopedia. 2018. Internet og Energy IoE. https://www.investopedia.com/terms/i/internet-energy-ioe.asp

Lacey, Stephanie. 2014. The Meaning of Disruption: How Should Utilities Think About Change? GreenTech Media. https://www.greentechmedia.com/articles/read/how-should-utilities-think-about-disruption

NextEra Energy Investor Relations (NEE Investor Relations). 2017. Investor Conference 2017. Presentation. June 22 2017. NY, NY. Presented by Jim Robo, Eric Silagy, Armondo Morales, Mark Hickson, John Ketchum. http://www.investor.nexteraenergy.com/~/media/Files/N/NEE-IR/documents/events/2017/june%20-2017-investor-presentation-final-website.pdf

Great post! I think you’re right that much of FPL’s fate will be determined by how willing they are to view digital transformation in their industry as an opportunity rather than a threat. Unfortunately, I would think that monopolies are generally least equipped to view shifting market dynamics in that way because when you already have 100% market share any shift in market dynamics likely feels like a threat. That doesn’t mean it’s impossible to adapt, just that I’d feel more confident about the ability of an incumbent to make that adjustment if they’re used to at least some competition. I would also be very concerned as to whether the same team that has thrived in a monopolistic environment will have the capacity to transition to a more entrepreneurial mindset.

On the bright side, it does sound like they have a forward-looking CEO who has done his best to not allow the organization to get too stagnant. I like the “Project Accelerate” concept because it gets employees used to thinking creatively about innovative solutions. Based on the changing market, I think the program needs to become more aggressive to think beyond simply “increasing revenues and decreasing costs” to also soliciting employee ideas regarding ways to position FPL as a leader of the industry’s digital transformation.

Hi Molly! Thanks for a great post! As someone who is moving to Florida, I thoroughly enjoyed it! I had also not read much about energy internet so it was very informative. FPL should hope to hire you back – your analysis is so comprehensive!

Like PD above, I too wonder how nimble a large incumbent like FPL is able to be, even if the management team is aware of the key issues and potential solutions.

I agree strongly that lessons from BSSE – both the threat/opportunity framing and the M&A strategy – could be very powerful here. If nothing else, FPL could make an acquisition and then stay passive while learning and observing its acquisition to see what are the key strategies that will win out.

Thanks again for the education. I love the idea of digital transformation in the energy space, and an “energy internet.” Will now be following the space!

Molly, thanks for the great post! I agree with your diagnosis that many energy and utilities companies are still playing catch-up with digitization, especially because the organizational structure they have worked so hard to build is the barrier to the transformation they badly need. I think an effective way to speed up transformation is to create a digital group that works with all the parts of the organization simultaneously to identify opportunities and to develop and implement solutions. Once the digital efforts become more commonplace within the organization, then each team can internalize their “sustaining” digital efforts, and the digital team can be responsible more for the moonshot digital ideas.

Hi Molly! Great post. Piggy-backing on the post above, I wonder how FP&L, before going straight into an acquisition can try to experiment and partner with a lot smart-energy and smart-grid startups to understand what is the right business model and value proposition for FP&L. But, I bet the organization is not very friendly to this small stage experimentation, so it would take the digital group or leadership to ensure that they build and learn from these partnerships.