Farmers Business Network | Disrupting One Farm At A Time

A young startup co-founded by an HBS grad has revolutionized the agriculture sector and put Big Agra in defense mode. And they’re doing so by crowdsourcing farmers’ data.

The agriculture industry is one of contrasts. In the US alone, there are over two million farms. Most of them are family-owned and average 440 acres per farm [1]. The fragmentation of farmers differs from the consolidation that the agrochemical and seed sectors have been going through. In the last years, the three mega-mergers of ChinaChem with Syngenta, Dow with DuPont, and Bayer with Monsanto [2] have tilted the power balance even more so towards input manufacturers. Together, these six companies control over 80% and 90% of the corn and cotton seed markets in the US respectively [3], a situation that critics characterize as oligopolistic.

The power imbalance between suppliers and buyers of seeds and chemicals, coupled with the fact that US farmers don’t set prices anymore since other countries are bigger producers, has prompted a squeezing-out of the American farmer. Seed and agrochemical companies have used the information asymmetry around crop yields and their opaque pricing to their benefit, pushing seed and pesticides prices up. The fundamentals of the industry –unpredictable weather, variable soil conditions, and very localized information sharing among buyers– have allowed seed companies to justify their products performance and margins so far.

Along this change in the agricultural landscape, two major shifts have occurred in the technology industry. Equipment manufacturers such as John Deere have introduced sensors into their equipment, enabling them to collect and transmit relevant data about soil, planting, irrigation, harvesting, local weather, etc. Meanwhile, big data analytics and machine learning have allowed for this data to become more actionable. IoT has reshaped the industry towards a ‘precision agriculture’ model, where farmers get to make smarter decisions on smaller pots of land, thus increasing yields considerably.

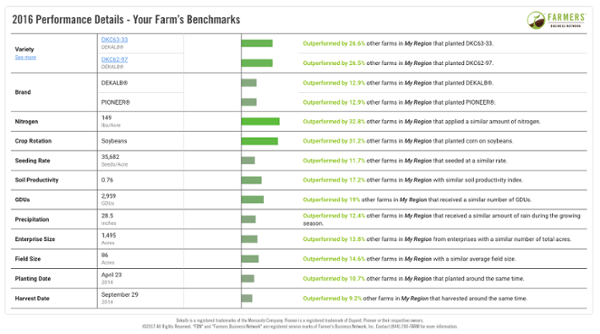

Co-founders of Farmers Business Network (FBN) Charles Baron (MBA 2013) and Amol Deshpande, both with close ties to the farming sector and with backgrounds in tech and VC, met in Silicon Valley in 2013 and decided to create a platform that would rebalance the bargaining power between input companies and farmers [4]. The platform fully depends on the crowd-sourcing of data that farmers collect both from their machinery and manually. Thus, farmers’ trust and FBN’s reputation are the key assets that enable them to operate. By aggregating and cleaning the data, the FBN team analyzes and benchmarks yields and prices from inputs, then provides the farmers with a user-friendly platform with data points for their negotiations with suppliers and for their overall decision-making process.

The crowd-sourcing platform has clear network effects, but still the founders decided to shift from a freemium model to a subscription flat fee of $600 currently. Early on, farmers’ feedback conveyed that they distrusted the free model and disliked fees variable with acreage. Since trust was a key component of the success, marketing in the early stages centered around word of mouth [5].

Beyond trust and its ‘Farmers First’ approach, FBN has been successful due to the value that it creates to every single farmer, with aggregate savings in the order of hundreds of millions of dollars [5]. Furthermore, the co-founders have understood how to leverage network effects, and as they’ve grown their customer base –currently at approximately 6,000 farms and information from as many acres as the state of Indiana–, they’ve expanded the customization by adding filters to their data and broadened their business model to include new verticals such as input procurement, financing and intelligence services [6].

The company, currently backed by long-term investors such as Temasek, T. Rowe Price, and Google Ventures, sees the IPO as the only viable exit strategy. An acquisition by any of the major companies in the sector would probably erode the trust of the data suppliers (i.e. the farmers) and destroy value. With a Series D that puts their valuation closer to unicorn status in 2017 [8] and numerous monetization opportunities down the line, investors are lining up at FBN’s door while employees of disrupted competitors leave angry comments on their Facebook [9].

Sources:

[4] HBS Case 9-217-025 “Farmers Business Network: Putting Farmers First”, by Prof. Shawn Cole and Tony L. He.

[5] Charles Baron.

[6] https://www.farmersbusinessnetwork.com/

[7] https://www.crunchbase.com/organization/farmers-business-network#section-funding-rounds

Awesome post, Juan, thanks! I had not heard about this company before but it is interesting to see the power of crowdsourcing in the US market as the power dynamics of the major producers shift from the US to other countries. In other classes we have read about western companies that are travelling to developing nations and helping to implement crowdsourcing products similar to this one to help farmers to make better informed decisions. It is really thought provoking to see an example of a Us based company that is helping local farmers as the power imbalance in the industry has shifted so heavily against them.

Very interesting! I wonder if FBN has approached the different lobbying groups (e.g., corn lobby) to get more support and thus, wider adoption. Scale seems quite important here as it looks like a winner-takes-all market. I’d also be interested to see if they have a mobile strategy. Emerging markets where agriculture is still the dominant industry could greatly benefit from data that FBN is providing. Given the proliferation of feature phones and basic smartphones, maybe a slimmed down UI that doesn’t require much data could be introduced.

Very Interesting. I was chatting with a VC in the sustainability and he purported that FBN is one of the only start-ups inn the AgTech space that is actually thriving. One question is whether the network effects are confined geographically, since so much of crop yield is determined by localized factors such as weather and soil conditions. 6,000 farmers across the country might not provide enough density for the data to be meaningful. Another question is whether there are any sort of online to offline opportunities to further build trust and community between small farmers. I will curious to track FBN in the coming months.

Great post! I have never heard of this company but it’s a great reminder that there are a lot of sectors still poised to benefit greatly from tech disruption. Am wondering whether they will become an acquisition target by one of the large chemical manufacturers?

Awesome post. We had a great discussion about FBN in Creating Shared Value last semester. You’re exactly right about the importance of trust and aligning the business’s interest with farmers—and against Big Ag—is an important differentiator for FBN. As they scale and build their network effects into more market power, I hope they are able to stay true to those roots. The founders presented a compelling case that they’d be able to based on their backgrounds and values, but shifting from being a data aggregator to a supplier and service provider will require them to be consistent in their “farmers first” approach.

Juan, thanks for sharing – this topic is extremely interesting! Your post brings up an interesting case where users associated trust with paying a subscription rather that a freemium model in traditional network platforms. I am curious about FBN’s growth to date. At 6,000 users, their penetration is only .3% of the U.S. market. What are some of the other barriers to user acceptance and are there any competitors in this space? I’m sure the value and stickiness of the platform increases with more users, so I wonder why user growth hasn’t been greater. My final question revolves around the insights FBN provides. You mentioned in your post that FBN provides farmers with pricing and yield benchmarks, but I wonder if it gives farmers detailed insights and/or recommended actions for each acre of land?