Equity investing for the masses: Is Indiegogo killing VCs?

Crowdfunding has been gaining more hype – especially in the last year since new regulation was passed allowing anyone in America to own shares of a private company. What does that mean for VCs? Why is Indiegogo positioned to win this game?

Crowdfunding has been gaining more hype – especially in the last year since new regulation was passed allowing anyone in America to own shares of a private company. What does that mean for VCs? Why is Indiegogo positioned to win this game?

What is Equity Crowdfunding?

Traditional crowdfunding portals such as Indiegogo and Kickstarter had been leaders in the rewards-based and donations-based crowdfunding, but the landscape is changing. Until May of last year, you could invest in one of many campaigns offering certain perks or early trials of products in return. Now, you can be an early investor in a promising startup and be part of its growth story, participating in its upside. You can contribute to the vision and feel like a proud owner of the products or services you believe in.

This is very much aligned with Indiegogo’s mission to fund people’s entrepreneurial endeavors. David Mandelbrot, Indiegogo’s CEO mentioned in a press release [1]:

“Sice Indiegogo first launched, we’ve wanted to offer these sort of investments, and we’re very excited to be officially giving the millions of people who visit our platform every month the chance to get involved with equity crowdfunding opportunities.”

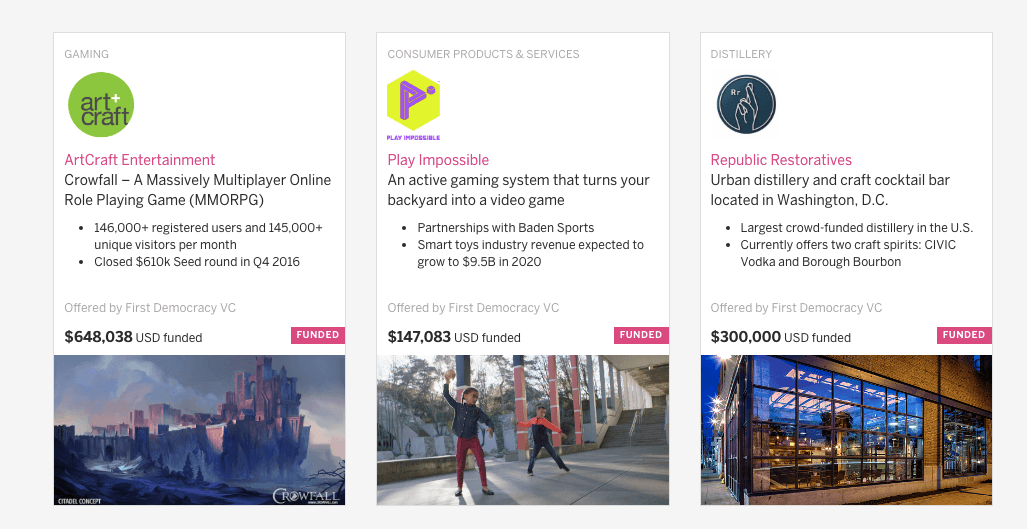

Exhibit 1: Sample Indiegogo Equity Crowdfunding projects online

The Mechanics: Using a Partner

Indiegogo adds a disclaimer under each investment opportunity that it is not a registered broker-dealer. The reason for that is the tremendous regulatory complexity in registering as a broker-dealer and being able to directly sell securities. It would also become legally liable for the investment claims and promises that each company makes. Instead, Indiegogo is able to do the share offerings through its partner, MicroVentures and its funding portal First Democracy VC, which is registered with FINRA [2]. Plus, MicroVentures has already a proven track record, having raised more than $100M from investors, which adds to the credibility of this investment method.

The Legislation: Still some limitations

With the passing of Title III of the JOBS Act (Jumpstart Our Business Startups Act) in May 2016, Obama reversed decades of restrictions on capital investments by American citizens. Prior to that only accredited investors with annual incomes above $200,000 or assets over $1M (excluding the value of a primary home) were able to purchase startup shares, which were not publicly listed on a stock exchange [3]. Still, there are certain restrictions on the investments – for example, a startup cannot raise more than $1M over a year and people cannot invest more than a certain percentage of their annual income, typically no more than $2,000 per year for Americans whose yearly income is below $100,000 [3] .

Traction: Viral growth has not yet materialized

According to Crowdfund Capital Advisors, equity crowdfunding commitments in the first six months after passing the regulation last May were around $14M [4]. In contrast, equity crowdfunding by accredited investors since 2013 has topped $1.47B from 300,000 investors using 16 different portals. The growth in equity crowdfunding by non-accredited investors has been slower than expected probably due to several reasons: 1) the investment limit of $2,000 is rather low, 2) startups are constrained by the amount they can raise using this method, and 3) equity crowdfunding is still in its infancy and has not yet gained the trust and understanding of unsophisticated investors, and 4) the listed opportunities are currently only a few and are mostly in Indiegogo’s traditionally funded categories such as video games or consumer products.

Kickstarter, Indiegogo’s largest rival, announced that it does not plan to enter the equity crowdfunding space [4].

Trust: So far so good

Indiegogo is one of the most reputable crowdfunding platforms. It has more than 15M active monthly users and has raised more than $1B from its 8M backers. It is a synonym for innovative ideas coming to live through the support of its numerous backers who are ready to pay upfront for a perk or product that will be delivered later. Despite numerous issues in the past of products not getting delivered on time or at all, Indiegogo’s success numbers are quite promising: numerous campaigns have raised more than $1,000,000 including Flow Hive Honey on Tap ($12M+), Sondors Electric Bike ($5M+), Onagofly Drones ($3M+) and others. Hence, Indiegogo is probably one of the best-positioned platforms to enter this new space.

Value Creation <> Value Capture

As a platform with a large user base and verifiable projects and entrepreneurs who list their ideas, Indiegogo is well positioned to enter the equity crowdfunding space. It already has automated many of the processes needed to raise capital and has solid customer service, compliance, and legal departments.

Indiegogo allows anyone who is 18 and above to invest a minimum of $100 per company. Funding amount is determined by the startups, which present a brief investment deck and will regularly update its investors on progress, milestones, and setbacks. As a platform, Indiegogo has not announced how it will profit from the endeavor, but it will likely be similar to its non-equity fundraising: it will keep a small percentage (typically 5%) of the capital raised and share that with MicroVentures.

Does this mean the end of VCs?

The power of the crowd is not to be underestimated. It is likely that regulation on the restrictions with equity crowdfunding will ease up in the near future. However, traditional venture capital investors have the experience and understanding of business models, deal terms, market dynamics, intellectual property, and, overall, what it takes for a startup to be successful. The LPs in a VC fund are aware of the timelines and risk that such investments require. While anyone can now take the role of the VC investor, it is unlikely that inexperienced investors will be able to secure the substantial amounts of capital that startups need to grow, round after round. Moreover, an equity crowdfunded startup might show great signs of early customer traction, this might not be a great indicator for a sound business model. Still, VC investments are able to provide the credibility that a statup has a higher chance of success. Of course, that is the case only until equity crowdfunding is able to disprove this with great stories of success.

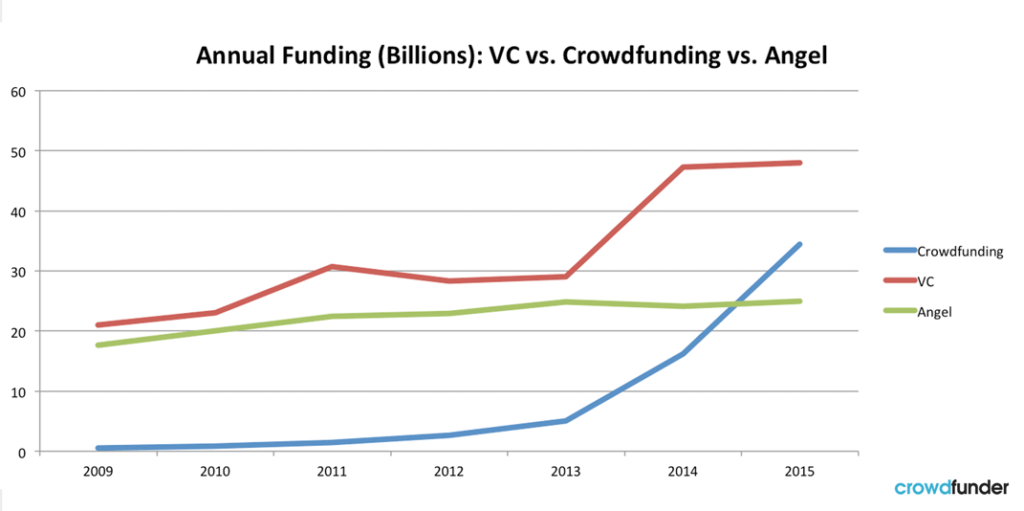

Exhibit 2: According to Crowdfunder, VC investing dominates, but crowdfunding is gaining rapid traction (2015).

Drawing the line:

For companies raising capital, this is a great opportunity to engage their early adopters and bring together their communities. For customers, this is changing the way people engage with the companies they support. Democratizing equity investments is the first step on a long journey of leveraging the power of the crowd to fund a viable business endeavor. Only time will tell if Indiegogo will emerge as the leader in this space. But until then, you are welcome to check it out and become a proud shareholder of one of the featured businesses such as ArtCraft Entertainment (a multiplayer online game) or Republic Restoratives (a DC-based craft cocktail bar and distillery) [5].

Sources:

[1] https://www.entrepreneur.com/article/285240

[2] https://techcrunch.com/2016/11/15/indiegogo/

[3] https://go.indiegogo.com/blog/2016/11/equity-investing.html

[4] http://www.cnbc.com/2016/11/16/crowdfunding-giant-indiegogo-gets-into-start-up-equity-funding.html

Interesting post! As the capital flowing into VC has ballooned in recent years, it will be interesting to watch Indiegogo’s trajectory and see if they are able to capture some of that growth. I agree with you that VCs should not be concerned (as of yet). VC investors also serve as a valuable resource to the companies they invest in — through contacts, advice, relationships, etc. These built-in benefits will make it difficult to replace the current structure in the short term, unless the capital is coming in at a significant discount through Indiegogo. I would also be interested better understanding the structure of these deals, the terms given to investors and the range of valuations. It would seem difficult to become a stakeholder while just accepting a blanket set of terms (without negotiations) and I wonder how Indiegogo streamlines this process.

Great point, dturenshine. I agree that VCs add a lot of credibility by syndicating deals. What Indiegogo can possibly do it work together with institutional/strategic investors, angels, and traditional VCs to syndicate a deal – for example, 80% of the capital is from VC and the last 20% comes from the crowd. This way people can trust that the terms they sign up for are “market terms” and individual people don’t commit to deals, which have unfavorable terms. I do not not what each deal looks like, but the valuation for now seems to be vetted by Indiegogo. Maybe in the future there can be a mechanism, in which the valuation and deal terms are also crowd-sourced?

Great analysis! I especially love your chart above showing how crowdfunding has surpassed angel (I’m really surprised, also hard to believe that VC is flat in 2015). Overall I think this is a great opportunity for individuals to invest in products and services that they would love to have in their lives. What I’m still not sure about crowdfunding is how individuals can share in the upside of success such as in angel and VC, because now I believe they share in the downside and very limited upside. There are some pretty troubling examples of crowdfunding not working out, such as the Lily Drone: http://www.recode.net/2017/3/17/14959490/bankrupt-drone-lily-refund-preorders, but overall I don’t think that a few bad eggs should mean we should shut down this industry, overall I believe it is huge net positive. But we will need some type of controls in place to protect individuals from being taken advantage of.

Thank you for your comment, Brandon K! I agree that many crowdfunding campaigns have gone awry and have created a bad rep in the industry. I would think of it this way: non-equity funding is more or less just a payment to receive a product (so success is more or less expected and should be close to 100%); however, equity crowdfunding is an investment in the growth of a business (and based on statistics, only 1% of startups actually make it big and maybe another 3-4% have some kind of exit, be it large or small) – so the expected success rate is by definition different. So what individual investors need to understand is the underlying risk of their investment. That can be fixed with education / blogs / tutorials and with success and failure stories.

On the point of adding more controls and not letting people invest in shady businesses — there’s already some controls based on the amount of annual income (2% or so) and the amount that each startup can raise (max $1M). The debate here is that some believe that people should be free to put their money wherever they want. Yes, banks can exercise control and stop giving you credit (money you have not yet earned), but no one really controls where you put the money you have actually earned.

Excellent post Lidiya. I really enjoyed reading it and watching the video. Do you have any color on the tax considerations that people will have to take into account before they invest in this type of vehicles?

Interesting point, Techie. I just did some research on the tax considerations of equity crowdfunding and here is what I found:

For the purchaser of an equity stake, tax implications are created when the equity is sold. The tax on your gains and the deductibility of your losses on the sale of equity in a company will depend on the seller’s tax bracket and the length of time for which you held the asset before it was sold. Capital gains are realized when equities are sold for a profit, whether that sale is to the issuing entity (liquidation) or to another individual (transfer). This profit is taxable to the stakeholder. Short-term capital gains are taxed the same way as regular income and are subject to different tax rates depending on the seller’s income bracket. Long-term capital gains are also subject to different tax rates depending on the seller’s income bracket, but the tax rates on this type of income are significantly lower than traditional income taxes.Capital losses are realized when an equity stake in a company is sold for less than its original purchase price or the company in question declares bankruptcy. The shareholder can write off short or long-term capital losses, depending on the life of the organization in question or the duration for which the shares were held. Short and long-term are measured by the same standards for losses as they are for gains.

So, in short, there is an implication only at the moment of sale or liquidation of the equity that you’ve bought. And the tax rate depends on the tax bracket of the seller. Hope this explanation helps!

Interesting point, Techie. I just did some research on the tax considerations of equity crowdfunding and here is what I found:

For the purchaser of an equity stake, tax implications are created when the equity is sold. The tax on your gains and the deductibility of your losses on the sale of equity in a company will depend on the seller’s tax bracket and the length of time for which you held the asset before it was sold. Capital gains are realized when equities are sold for a profit, whether that sale is to the issuing entity (liquidation) or to another individual (transfer). This profit is taxable to the stakeholder. Short-term capital gains are taxed the same way as regular income and are subject to different tax rates depending on the seller’s income bracket. Long-term capital gains are also subject to different tax rates depending on the seller’s income bracket, but the tax rates on this type of income are significantly lower than traditional income taxes.Capital losses are realized when an equity stake in a company is sold for less than its original purchase price or the company in question declares bankruptcy. The shareholder can write off short or long-term capital losses, depending on the life of the organization in question or the duration for which the shares were held. Short and long-term are measured by the same standards for losses as they are for gains.

So, in short, there is an implication only at the moment of sale or liquidation of the equity that you’ve bought. And the tax rate depends on the tax bracket of the seller.

Interesting post! I did a bit research when I was interning at JD in the past summer about U.S. equity crowdfunding market, and Angellist and Wefunder stood out at that time as leading players, while Indigogo was more of a benchmark of Kickstarter for financing crowdsourcing, or a new product/idea marketing platform. I wonder if you have any idea regarding the competitive dynamic between Angellist and Indigogo, and why Kickstarter decided to focus on its original territory.