Deloitte X : How to Reinvent Consulting

I have spent 4 years at Deloitte Consulting both as a consultant who had to transform my work and as a manager who took a leading role in Deloitte’s transformation in EMEA region. Deloitte has been facing significant challenges and opportunities while going through its digital transformation.

Introduction

Management consulting has a timeless value proposition which is to help top management to make informed and better decisions. Main resources are top talent, know-how and best practice sharing. Key capabilities are in-depth analysis, structured thinking, business acumen and data-driven judgement. As long as companies face with strategic decisions and lack of access to specific top talent or expertise, management consulting will remain as a profession.

Management consulting has a timeless value proposition which is to help top management to make informed and better decisions. Main resources are top talent, know-how and best practice sharing. Key capabilities are in-depth analysis, structured thinking, business acumen and data-driven judgement. As long as companies face with strategic decisions and lack of access to specific top talent or expertise, management consulting will remain as a profession.

Technology has always reshaped consulting industry. First consultants were accountants until they were equipped with computers and office programs, consulting was being done with overhead projectors and transparencies. As technology evolved, Deloitte has been able to adapt and even take advantage of emerging resources and capabilities. Talent-oriented light asset model has enabled Deloitte and other consulting firms to successfully and flexibly respond to threat of disruption.

Digital disruption requires critical business model innovations from incumbent consulting firms in a way to response to risk of substitution by algorithms, meet shifting customer demands and integrated emerging cutting-edge value creation resources.

Deloitte provides audit, tax, consulting, enterprise risk and financial advisory services with more than 263,900 professionals globally. In FY 2017, the network earned a record $38.8 billion USD in aggregate revenues. Deloitte is the 6th-largest privately owned organization in the United States.[1]

I have spent 4 years at Deloitte Consulting both as a consultant who had to transform my work and as a manager who took a leading role in Deloitte’s transformation in EMEA region. Deloitte has been facing significant challenges and opportunities while going through its digital transformation.

I have spent 4 years at Deloitte Consulting both as a consultant who had to transform my work and as a manager who took a leading role in Deloitte’s transformation in EMEA region. Deloitte has been facing significant challenges and opportunities while going through its digital transformation.

Disruption Challenges & Opportunities

Challenges

Emerging technologies present threat of substitution for Deloitte. Cutting-edge improvements such as Big Data, AI, IOT and Cloud are increasing the capabilities of Deloitte’s clients. Access to big data is replacing market research and data collection capabilities of Deloitte. Major companies have already established internal strategy teams to perform some of outsourced consulting projects in-house. They are now expanding in-house capabilities to analytics to utilize large set of available data. Analytics capabilities are replacing Deloitte’s analysis capabilities. On top of data, advanced data collection, storage and processing technologies enable firms to improve their analytical capabilities significantly. Similarly, increasing availability of low cost visualization tools replace Deloitte’s reporting capabilities. The most difficult to disrupt capability is business acumen and judgment is being threatened by the developments in Artificial Intelligence. AI algorithms are increasingly being capable of generating insights from large set of unstructured data that will help top management make better strategic decisions. Quantitative trading demonstrates a great example for how Big Data can disrupt judgement based business such as investment and hedge funds. A similar disruption is inevitable for consulting in a foreseeable future.

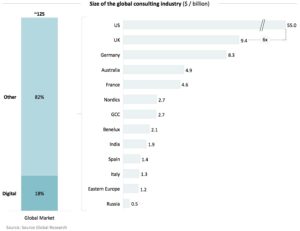

Customer’s consulting needs are shifting away from legacy business segments to tech-enabled novel business lines. At traditional strategy-consulting firms, the share of work that is classic strategy is now about 20%—down from 60% to 70% some 30 years ago. [2] Deloitte clients in every vertical is also going through a digital transformation. Many of them have a high willingness to pay digital consulting. “The booming digital transformation consulting market is worth $23 billion today, according to a report. In total, the sector now represents more than 15% of the entire consultancy industry, while taking root most extensively in the UK, US, and Australia.” [3] Digital consulting is significantly different than traditional strategy and operations consulting. Clients demand in-depth know-how about cutting-edge technologies. In digital age, project types are getting more specialized compared to traditional generalist approach. More modular approach is needed compared to turnkey bespoke projects. As digital increases measurability of interventions, clients shift to more incentive based project structures. In fast changing uncertain world, long term strategy projects lose their viabilities.

Shifting customer demands create new competitors for Deloitte with disruptive business models. Deloitte is facing increasing competition from specialized firms across digital transformation, analytics, and design-thinking. Salesforce is a great example of new age consulting company. Palantir is utilizing bi-data to develop analytical solutions. The big data company BeyondCore can automatically evaluate vast amounts of data, identify statistically relevant insights, and present them through an animated briefing, rendering the junior analyst role obsolete. And the marketing intelligence company Motista employs predictive models and software to deliver insights into customer emotion and motivation at a small fraction of the price of a top consulting firm. “These start-ups, though they lack the brand and reputation of the incumbents, are already making inroads with Fortune 500 companies—and as partners to the incumbents.”[4] On the other hand, Catalant is trying to disrupt with architecture innovation. Its platform business model connects clients with free-lance consultants.

Opportunities

Demand for digital transformation and analytics consulting created a new S curve for Deloitte. The pace of growth in this field outpaced the growth in legacy business by far. There is a huge know-how, technology and talent gap in digital age to be explored and exploited by Deloitte. Deloitte can position itself to provide clients essential capabilities, guidance and talent to survive through digital transformation. Another big opportunity exists in global markets. As Gibson says: “The future is here but not evenly distributed”. Deloitte can help global and local companies across the world by making future more evenly distributed sooner than later. Deloitte’s integrated approach towards strategy and operations coupled with global presence can be its differentiation points in value creation and capture.

Demand for digital transformation and analytics consulting created a new S curve for Deloitte. The pace of growth in this field outpaced the growth in legacy business by far. There is a huge know-how, technology and talent gap in digital age to be explored and exploited by Deloitte. Deloitte can position itself to provide clients essential capabilities, guidance and talent to survive through digital transformation. Another big opportunity exists in global markets. As Gibson says: “The future is here but not evenly distributed”. Deloitte can help global and local companies across the world by making future more evenly distributed sooner than later. Deloitte’s integrated approach towards strategy and operations coupled with global presence can be its differentiation points in value creation and capture.

Deloitte’s transformative actions

Deloitte has been transforming itself to be better positioned in digital age through Deloitte Digital, Analytics center of excellence, Center for Edge, Innovation B.V, acquisitions and Singularity University.

Deloitte Digital has been the most successful venture developed by Deloitte in recent decades. It is managed completely separated with a domain expertise. Deloitte Digital mimics Silicon Valley culture with an huge emphasis on creative consultancy across disruptive technologies. Success of Deloitte Digital solutions in digital sales and marketing made it one of the biggest advertising agencies. It is active with 48 studios in 29 countries and 9k employees already. Deloitte Digital formed alliance with top technology providers such as Google, Adobe and SAP. It is more competitive than Deloitte brand in attracting top talent. However, its integration into core business lines, share of know-how and best practices are limited. Its global penetrations is slow. Talents from other business lines want to switch to Digital leaving the legacy businesses vulnerable. Hence, Deloitte is not able to push Digital full-force. The word “Digital” mentioned only 8 times in 184 pages annual report. [5]

Center for Edge and Singularity University are the initiative to position Deloitte as a thought leader. Deloitte’s Center for the Edge develops original research and substantive perspectives on new corporate growth. Based in the Silicon Valley, with teams in Europe and Australia, we help senior executives make sense of and profit from emerging opportunities on the edge of business and technology. Singularity University (SU) and Deloitte recently announced a renewal and expansion of a four-year alliance to bring opportunities for innovation to entrepreneurs and large organizations around the world. Leveraging their collective capabilities, Deloitte Consulting LLP and Singularity University educate and catalyze organizations regarding the disruptive impact of exponential technologies, and accelerate their transformation journeys to envision and realize exponential opportunities. However, thought leadership initiatives should go beyond just PR and generate implementable insights and innovation.

Transformation through acquisitions is an essential strategy of Deloitte. The firm recently acquired many new ventures from IOT to Design Thinking. IDEO was the most spectacular acquisition. In 2016, Deloitte Digital acquired award winning creative agency Heat. Recently, Deloitte announced today a significant investment in cloud management services by acquiring assets of ATADATA, an Atlanta-based provider of a holistic cloud platform that maps, migrates and manages workloads in any combination of on-premise and cloud environments to drive and optimize enterprise operations. Deloitte also invests on scaling start-ups across emerging technologies. Acquisitions and partnerships help Deloitte to gain access to talent and know-how. However, integration is always painful. Existing Deloitte culture creates constraints for high-growth tech companies.

Deloitte’s Organizational Challenges

Main organization challenge is to allocate resources in new business line while exploiting the legacy business simultaneously. Strategy and operations business line where shrinking while digital transformation business was exploding. Deloitte had to hire new senior management teams with digital and Big data backgrounds in order to grow new business lines. Shifting budget and management time resources cause organizational resistance from incumbent partners and directors. Most of them are at expert in their fields and contributed to the firm’s success for a very long time. However, partners of incumbent segments are about to be obsolete while their colleagues in emerging fields were enjoying high growth and better compensation packages.

Main organization challenge is to allocate resources in new business line while exploiting the legacy business simultaneously. Strategy and operations business line where shrinking while digital transformation business was exploding. Deloitte had to hire new senior management teams with digital and Big data backgrounds in order to grow new business lines. Shifting budget and management time resources cause organizational resistance from incumbent partners and directors. Most of them are at expert in their fields and contributed to the firm’s success for a very long time. However, partners of incumbent segments are about to be obsolete while their colleagues in emerging fields were enjoying high growth and better compensation packages.

Talent acquisition and development gets harder and harder. Kennedy Research estimates that turnover at all levels in prestigious consulting firms averages 18% to 20% a year. [6] There is a talent scarcity in digital fields. Deloitte has to compete with not only other consulting firms but also silicon valley and start-ups. Compensation alone is not enough to attract millennial talent. Intrinsic value and firm culture play a bigger role. Challenges don’t end after hiring the top talent. Developing new hires and transforming the skill set of existing talents require a big shift in Deloitte’s training practices and large resources. Majority of top talent with relevant skill set and experience is concentrated in developed markets whereas Deloitte need to serve global markets around the world.

The cultural transformation is demanding. Imagine a workplace with millennial talent, creative digital talents, data scientist and traditional management consultants. Making them all live together in a harmony is a difficult task. I personally worked with all different types of talents during this transformation. New hires have completely work culture than existing. Millennials prefer freedom and responsibility rather than traditional consulting hierarchical management style. Similarly creatives do not wear suits or prepares power point presentations with full of data. Data scientists and business consultants can’t speak the same language. New comers are not comfortable with long hours of consulting.

Integrating the cutting edge technology across the Deloitte’s way of doing business is time and budget consuming. Replacing excel with Qlikview, Microstrategy or SAS is a heavy investment on software but most importantly requires a significant portion of top management focus. Equipping every consultant with recent technology takes between 12-18 months in a typical regional office. Without top management involvement, coping with resistance to embrace new technologies and integrating them into consulting projects is not possible.

Integrating the cutting edge technology across the Deloitte’s way of doing business is time and budget consuming. Replacing excel with Qlikview, Microstrategy or SAS is a heavy investment on software but most importantly requires a significant portion of top management focus. Equipping every consultant with recent technology takes between 12-18 months in a typical regional office. Without top management involvement, coping with resistance to embrace new technologies and integrating them into consulting projects is not possible.

The last but not the least challenge is to rethink the project structure and client engagements. Traditional bespoke model without any concrete measurable deliverables don’t work anymore. Digital age requires flexible, specialized, measurable value creation. Selling and delivering modular solutions rather than bespoke projects demand multifunctional teams to research, iterate, develop and productionalize the know-how. Revenue model is shifting from fee based to KPI based. I developed pricing optimization projects for retailers working with multifunctional team of analysts, statisticians, data scientists and industrial engineers. On the contrary of traditional projects, there was no way to come with separate modules, daily project timelines or even a near accurate deadline. It was more of a iterative process of any start-up demands high degree of collaborating between team members. After developing the project, we implemented at the first client. We were responsible for short-term results for the first time and it was not something we felt comfortable in the beginning. Later, we sold the same product over 10 different clients with complete different revenue model. Process from project acquisition to deliver was an adventurous discovery.

Recommendations for an effective digital transformation

Embrace the mission for being agent of change and making future more evenly distributed. An overarching vision will emotionally and strategically engage everybody in the organization. Deloitte can explore and exploit the opportunities in digital transformation by helping its clients across the world to close the competency, know-how, resources and talent gap. Aligning the firm around this mission after getting strong buy-in from top executives is critical. Deloitte is still struggling to choose between its legacy business, talent and culture and novel opportunities. Deloitte should invest heavily on internal marketing of new direction and align incentives of top management with the new mission.

Talent and resources transformation should be accelerated with a bolder top-down approach. Strong top management buy in is critical in change management. Partners of legacy business with competency gap and less valuable skills should be convinced to transform themselves or be replaced with more motivated top management. Similarly, at the base of the pyramid, hiring practices should be completely changed. Even the case method should be questioned and replaced with an approach to find talents with passion for innovation, change and flexibility. Deloitte should invest on talent training more aggressively. Every single talent all around the world should be equipped with relevant skills and experience at the heart of digital disruption by experts and though leaders. New consultant talent should be more than just a generalist and be able to play the bridge role between technology and business. They should be equipped with latest technology. All non-value add analyst work should be automated so that talent can spend his/her time generating deeper insights.

Deloitte should follow a virtuous cycle of exploit and explore with an ambidextrous organization structure. “Ambidextrous organizations separate their exploratory units from their traditional, exploitative ones, allowing for different processes, structures, and cultures; at the same time, they maintain tight links across units at the senior executive level. In other words, they manage organizational separation through a tightly integrated senior team.” [7]. There should be domain separation for the new business lines managed by a separate senior manager who directly reports to CEO. He should be empowered and held accountable for the success of emerging businesses. Constraints of existing culture and business model should not constraint the growth of novel opportunities. CEO’s KPIs should prioritize the success of transformation. Acquired companies should be managed separately with a light integration approach. Culture should be built around discovery, creativity, innovation and speed. Start-up mindset should be embraced by top management and diffuse-down to most junior analyst. There should be a constant push for new blockbuster, discontinuous innovations followed by exploitation and incremental integration of blockbusters to existing businesses.

I would like end with a quote from Clayton Christensen: Furthermore, the pace of change being managed by the traditional clients of consulting firms will continue to accelerate, with devastating effects on providers that don’t keep up. If you are currently on the leadership team of a consultancy and you’re inclined to be sanguine about disruption, ask yourself: Is your firm changing (at least) as rapidly as your most demanding clients? [8]

Main Sources:

1, 5- https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/about-deloitte/deloitte-nl-integrated-annual-report-2016

3-https://www.consultancy.uk/news/13489/digital-transformation-consulting-market-booms-to-23-billion

2, 4, 6, 8 2017.pdfhttps://hbr.org/2013/10/consulting-on-the-cusp-of-disruption

7- https://hbr.org/2004/04/the-ambidextrous-organization

Other sources:

- https://www.deloittedigital.com/

- https://www.forbes.com/forbes/welcome/?toURL=https://www.forbes.com/sites/falgunidesai/2016/03/23/the-rise-of-digital-consultancies/&refURL=&referrer=#12a617096a7

- https://hbr.org/ideacast/2013/09/clay-christensen-and-dominic-b?referral=03759&cm_vc=rr_item_page.bottom

In 2017, Deloitte reported its second consecutive year of double-digit growth. One year before, David Sproul, Senior Partner and Chief Executive of Deloitte, had alredy commented on the secret-sauce recipe: “We’ve invested in developing our capability across emerging business disruptors, such as blockchain, crowdsourcing and robotics, working to ensure we can help our clients position their businesses for future growth.”

Many have relegated Deloitte to the Big 4 group, distinct to the big 3 BBM management consulting firms, but now that the industry is re-accomodating itself, it will be very interesting to assess whether being able to invest in anticipation in disrupting technologies will allow Deloite to emerge as a winner in the Digitalization Era with enhanced capabilities to solve consulting clients changing problems. Or if instead the BBM trident will be able to catch up an defend its predominance.

https://www2.deloitte.com/uk/en/pages/press-releases/articles/deloitte-reports-fastest-revenue-growth-in-10-yrs.html