Big Data in Big Agribusiness: Monsanto Monopolizes America’s Farms

Forget the Domino’s Delivery Car- The future of food is the data-driven tractor

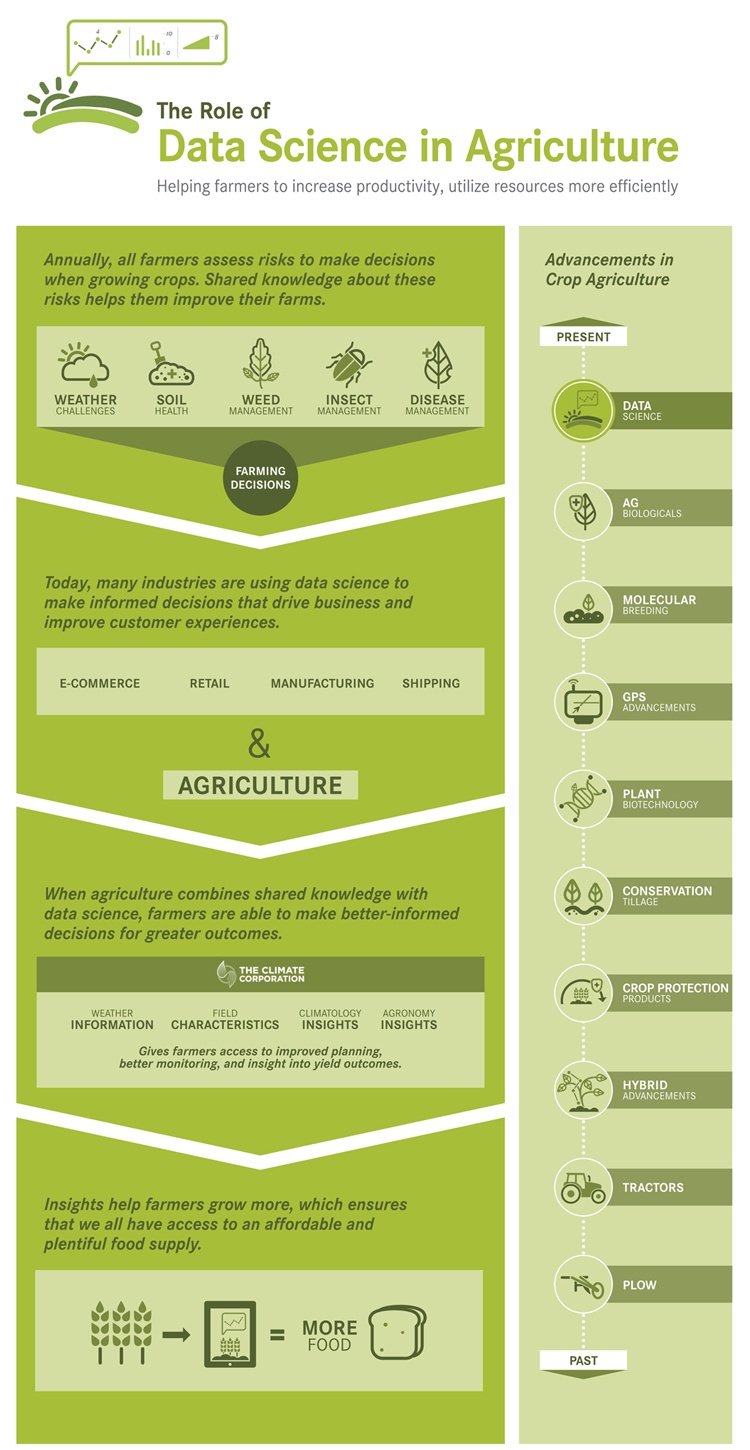

While Agribusiness has arguably been slow to the big data party, there is no question that the industry is swiftly adopting data-driven technology. From highly accurate GPS-driven “self-driving” tractors, to environmentally impacted seeding plans, big and small farms alike are taking notice. Companies have invested heavily in recent years to harness the power of data analytics. “Food” giant Monsanto has led the way. In 2012, Monsanto acquired The Climate Corporation, a data analytics platform that aims to “help farmers around the world protect and improve their productivity,” for $930 million.

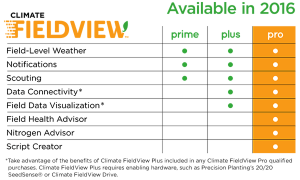

Prior to the acquisition, Monsanto implemented their Integrated Farming Systems research platform, providing field-by-field recommendations in order to assist farmers in maximizing yield as well as manage risks. The Integrated Farming Systems’ first offering, FieldScripts™, used a combination of Monsanto’s proprietary algorithms and their global science database for seed and biotechnology. The Climate Corporation offered a proprietary platform called Climate FieldView™, which adds on an additional layer of local weather data at the field level, enabling famers to make even more informed decisions.

As of September 2015, Monsanto offers three tiered product offerings of Climate FieldView™ (Prime, Plus, and Pro), with their premium offering (Climate FieldView™ Pro) seamlessly connecting field data to the cloud. For the first time, this digital platform allows farmers to combine their field data with real-time and historic data from soil, weather, and crop yields to manage their day-to-day operations. In 2016, the product will continue to expand, allowing farmers even more control as they expand geography, and giving them custom input options for variable rate seeding prescriptions, allowing easier data input, and options for which farm equipment to link to the process.

This year, the platform has been used by farmers across 75 million acres (as of 2012, there were over 900 million acres of farmland in the US, for an average farm size of 433 acres). In the upcoming season, they plan on offering the Pro service for $3 an acre, or a software subscription service plus hardware for $999-$3,999/year. The Prime™ version is available for free. In addition to what they already pay for seed and insecticide alone from Monsanto (which varies largely by crop type, size, and location), a Farmer with an average sized farm would be on the ropes for several thousand dollars to give their data to Monsanto. While the revenue from this service may seem like chump change, I think it is a bigger play by Monsanto.

Monsanto’s main products are seeds that are genetically modified via their “world class breeding program” to modify plants’ characteristics for herbicide, drought, and insect tolerance. By producing and selling these products at steadily increasing prices, they have captured sound profits. Their complete product portfolio ensures that Monsanto has a captive market. After selling farmers Roundup™ Resistant seeds to plant, they close the loop by then selling them the Roundup™ to kill the weeds. Monsanto has managed to develop local monopolies, where farmers are perpetual customers of both products (and, contractual agreements ensure that farmers can’t save seeds for re-planting). Monsanto also has a reputation for aggressive selling tactics (and bullying of farmers and relentless patent protection). In 2008 the company spent a reported $2mil a day on R&D in order to introduce a constant stream of “upgraded” products, compelling their customers to continue purchasing year after year.

The whole value play behind GM seeds is that they increase crop yields and save money. So far, it is not clear whether using Monsanto GM seeds actually saves farmers money (they do have to rebuy every year, and they also have to buy the complementary products). Roundup™ is certainly a convenience product- a farmer plants their crops, and then uses Roundup to kill the weeds, eliminating the labor intensive weed control process and giving time back to the farmer. By adding in a Data analysis tool, Monsanto will gain even further control over the process. By gathering and analyzing data points from its customer base, it will grow the sphere of control and influence it has over our food sources.

It is a clear that the additional layer of data analytics is a value-add to the customer, as they will have better tools to plan and track their crops. Undoubtedly, the melding of historic data with real-time analytics will lessen the risks involved with modern farming. However, Monsanto can and will use this tool to further hold the customer captive. By giving more catered recommendations, it will increase both the revenues for Monsanto (new software and hardware, subsequent upgrades, more and new seeds, insecticides, etc.), and improve productivity and yield for the farmer. As farmers integrate a more modern system with improved and automated data-driven features, I can imagine a world where Farmers become dependent on this technology to be a crucial point in their decision making process. By offering this as a subscription service (assuming it is a reliable and valuable product), the company is ensuring a constant stream of revenue from farmers whose livelihoods will now depend on Monsanto and their entire portfolio of products. My question remains: Is it in the best interest of the farmer to have Monsanto (by way of the FieldView ™ product) so integral in their decision making processes?

Interesting post – agriculture is definitely a prime area for using big data to capture value. I find it interesting that Climate Corporation used U.S. weather data from the government’s open platform data.gov to build their business and went on to sell to Monsanto. I agree with your hesitation about what it means for the farmers that Monsanto now owns their data and may become integral to their success.

Great post on big data in agriculture. There have been many startups that leverage data to advance agriculture, e.g. Blue River Technology, etc. I think it will be hard for Monsanto to own the entire data chain given the market size and competitive landscape. I’m hoping there will be more companies that will enter the agritech space to help balance and enrich the ecosystem.