Big C Supercenter: the pursuit of omnichannel strategy

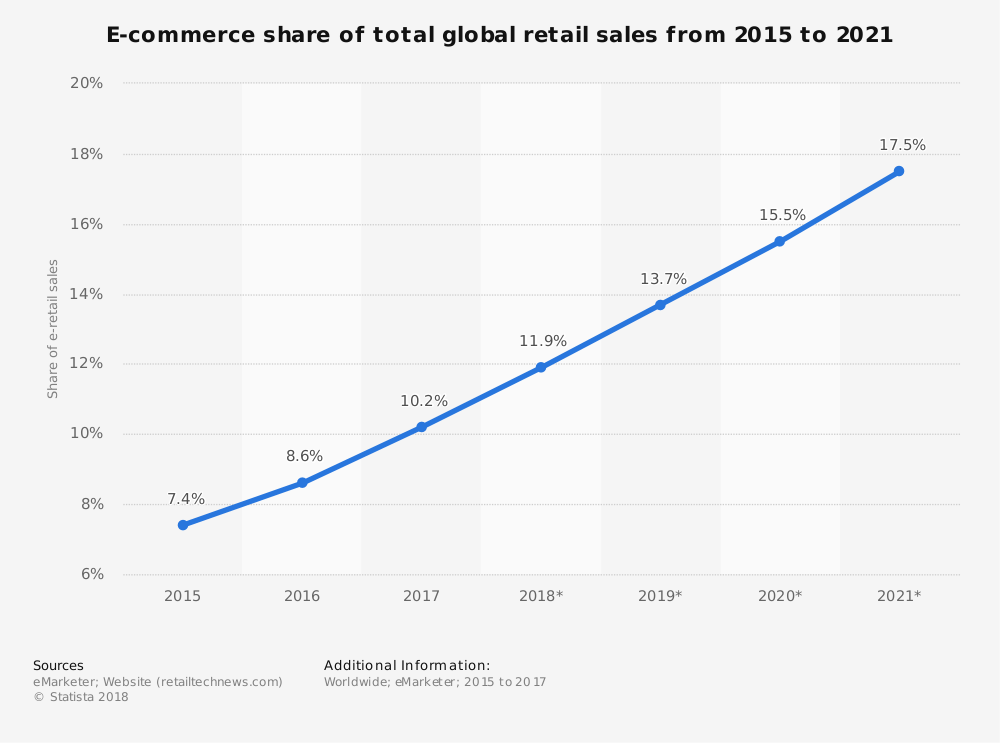

E-commerce is one of the most significant trends in the digital transformation in the 21st century. From a massive e-commerce company such as Amazon in the US and Alibaba in China to a smaller local player like Shoppee, in Southeast Asia, countless of e-commerce companies disrupted traditional retailers. Today, almost 12% of all global retail sales are from online. The share is expected to reach 17.5% by 2021[1].

I had a chance to work with Big C Supercenter 2016 before joining HBS. Big C is a traditional hypermarket company based in Bangkok, Thailand. The company is the second largest hypermarket’s retailers in Thailand with over USD 3.6 billion in revenue[2]. Since its inception, the company has entered into multiple new formats such as supermarket, convenient store, and even e-commerce. However, the company has yet to figure out the right formula to run the business in the midst of competition from e-commerce players. Since Big C operates mainly in Thailand, the shift in e-commerce trend is critical to the company. In 2018, 12.7 million consumer in Thailand shop online. This number is expected to grow at 15% per annum reaching 13.9 million in 2021. The e-commerce penetration is at 22.7%[3]. In 2017, Thai consumer spends close to USD 1.9 billion through internet retailing[4].

Digital transformation provided incumbent brick and mortar retail player such as Big C with immense opportunity. Big C has a chance to adopt the omnichannel strategy and create a seamless and complimentary experience between online and offline for customers. While most online players struggle to enter into brick and mortar due to limited funding and/or lack of available prime location, Big C enjoys the benefit of having extensive offline reach across Thailand. The company has 131 hypermarkets, 59 supermarkets[5], and close to 600 convenient stores[6] available to serve as a customer touch point. The company also has two existing e-commerce stores called Cmart and Big C shopping online. While the latter only sells a subset of product available at Big C, Cmart store sells more than just Big C product. The strategy would allow Big C to not only keep their core business intact but also enables Big C to competes and grow in the growing e-commerce sector.

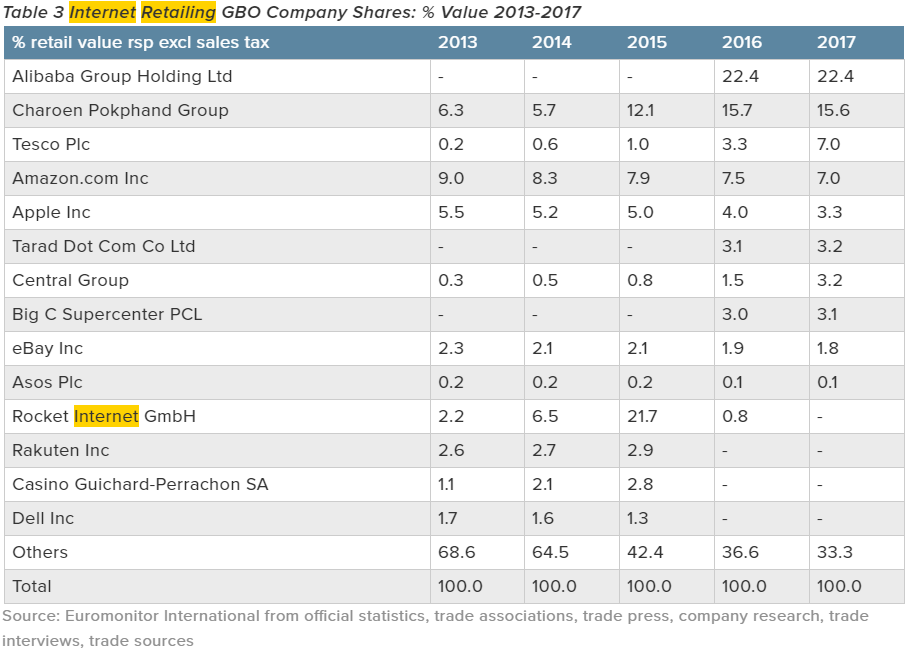

However, there are three key challenges that Big C has to overcome to compete in the new era of retail. First, Big C needs to fight in the midst of intensifying competition. Despite having two e-commerce websites and massive brick and mortar store network, Big C is still far away from realizing the omnichannel potential. As a result, the two e-commerce websites struggle to gain market share. In 2017, the Alibaba backed and former Rocket Internet owned, Lazada group, through substantial investment, captured 22.4% of internet retailing market share in Thailand. The company established itself as a clear market leader, winning by ~7% margin. Big C, on the other hand, owns 3.1% and ranked 8th in the internet retailing market. The competition continues to intensify with Shopee; a Tencent backed e-commerce entered and competed in the region.

Second, Big C need to embrace the new nature of an e-commerce business. As a traditional, modern retailer, Big C enjoys a profitable business and behave like a cash cow company with limited new investment. It is difficult for Big C to compete against other e-commerce giants that invest heavily to gain market share. For example, Lazada revenue was USD 310 million in 2015, an income that increased by 78% from the previous year. The cost of the growth, however, was USD 334 million in a loss for the year, more than doubled the loss in 2014[7]. During the same time, while I was working at Big C, the company was trying to figure out how to squeeze profit out of its e-commerce businesses. While it is important to be profitable, Big C needs to balance between market share growth and profitability. This tradeoff was unprecedented in its traditional industry.

To overcome the first two challenges Big C needs compete strategically. The company has not only extensive physical store footprint but also the fresh grocery. Big C should leverage its store to include fresh grocery in its online offering. Furthermore, the retailer should treat most of its store as a logistics hub. This way the company could minimize the cost of last mile delivery. Moreover, by having goods sent to the nearest store to the customer, Big C could incentivize them to come pick up in store for a discount and increase the basket size as customer tend to shop in the physical store as they come pick up their product.

The third challenge is less about the strategic decision but more about the implementation. Big C has a very silo organization with the organizational structure that aims to operate physical retail stores. When the company introduces its two e-commerce teams, they were both separated from the organization. Cmart (Cdiscount at the time) was a subsidiary, while Big C shopping online was a separate small unit. There were little communication and integration between e-commerce sites and core business. Furthermore, the two e-commerce sites were also wholly separated. Hence there was little attention given to the e-commerce businesses. On top of the structure, the culture is another challenge. The company hasn’t had any disruptive innovation since its inception. Big C deprioritized innovation to the point that it shut down its business development unit in 2015. There was no culture of innovation in the organization.

To implement the omnichannel strategy Big C has first to set clear goal and mindset. The purpose of competing in the online retail world to avoid being disrupted by digital transformation must be aligned throughout the organization. Talent acquisition and reorganization of an existing organizational structure are key.

Big C needs to integrate its e-commerce businesses with the offline retail industry. However, there will be resistant to an existing business. To implement any integration or initiatives for e-commerce sites mean Big C has to shift its core business in favor to the small, unprofitable business. Many senior executives in the company often view this as extra work and resist the implementation. The slow-moving nature and reluctant to change attitude affect the company ability to attract new generation talent with expertise in technology.

It might not be an easy task to change the culture of the company; however, given the situation, it is vital for the CEO of Big C to set the focus of the company. To avoid resistance, the leader needs to explain the shift in the competitive landscape and consumer behavior. Each executive member needs to understand that digital transformation is vital to company’s long-term survivability. Executives that resist or fail to adapt will need to be let go and replaced with someone with online retail experience.

The silver lining is that today Big C is no longer a listed company. This will ease the pressure on the company to perform in the short-term basis. It will allow the CEO with a long runway to implement a

[1] https://www.statista.com/statistics/534123/e-commerce-share-of-retail-sales-worldwide/

[2] https://issuu.com/ar.bigc.si/docs/20170324-bigc-ar2016-en

[3] https://ecommerceiq.asia/online-shoppers-thailand/

[4] http://www.portal.euromonitor.com.ezp-prod1.hul.harvard.edu/portal/statisticsevolution/index

[5] https://issuu.com/ar.bigc.si/docs/20170324-bigc-ar2016-en

[6] https://corporate.bigc.co.th/en/about/bigc/

[7] https://techcrunch.com/2016/04/14/spiralling-losses-show-lazada-desperately-needed-alibaba-investment/