Beauty & Brains: Using Big Data to Build a Better Bra

With over 130M data points, the True&Co. proprietary algorithm is working to reinvent the way women shop for better, personalized intimate apparel.

In 2012, Michelle Lam founded True&Co., an e-commerce startup focused on collecting and analyzing customer data to improve the bra-buying process. Lam researched what it would take to reinvent women’s intimate apparel, but quickly realized that “the more data you have, the smarter decisions you can make.”[1] Unfortunately, Lam had no data, but she knew where to get it (from potential customers) – and, importantly, what she could do with it (engineer better bras). True&Co. was born.

Value Creation

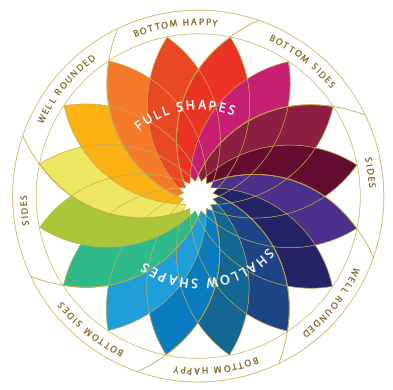

True&Co was the “first company to develop… a unique algorithm to find your fit.”[2] Over the last several years, more than five million women have taken True&Co.’s Fit Quiz, which has also served as an organic traffic acquirer[3]. Lam and her team create value by leveraging customer datasets to identify 6,000 body types. Using that data, True&Co.’s algorithm will recommend the most comfortable and well-fitting bra for a customer, without her ever having to walk into a dressing room or take measurements at home. The company has dubbed this literal treasure chest of information TrueSpectrum.

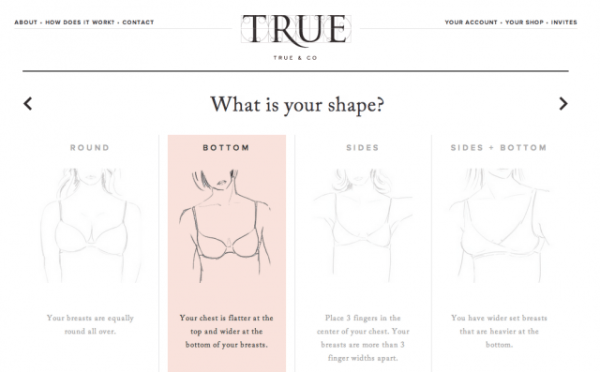

The True&Co. online quiz takes two minutes to complete and asks a range of questions, from favorite colors to current dress size. The questionnaire also captures a wealth of information about the fit of a customer’s current bra: whether the straps fall down or are too tight, or if the bra becomes uncomfortable as the day goes on. True&Co.’s online quiz enables the retailer to monitor trends in colors, fabrics, or other kinds of apparel (e.g., bodysuits).

With its data-centric design, True&Co. differentiates itself on perceived personalization and overall better fit. The latter can be challenging for industry incumbents to rival or replicate, since larger companies typically produce garments from fit models or “spec” sizes, optimizing to fit a wide range of customers adequately rather than fitting a handful of customers well.

Value Capture

Bra purchases account for about 50 percent of the total market for lingerie globally, estimated at about $28.6 billion[4] [5]. True&Co. captures value from the sale of products on their site, but the more significant opportunity lies in the rich, proprietary data collected throughout the transaction process.

True&Co. segmented bras into 20 different components which translate into 50 different data points. Fit Quiz asks a customer not just about the bra size she thinks she wears today, but also about the other brands she wears and how those brands fit her. The algorithm then “translates” fit based on self-reported information and the typical fit found among other brands[6]. Every product decision, from color to cut, comes from insights generated by Fit Quiz, as well as post-purchase feedback. Data showed that women preferred dark colors 3x more than lighter ones, which informed True&Co. designer Nikki Dekker’s decision to create “elevated neutrals” but in darker, more contemporary shades, like charcoal[7]. Importantly, True&Co. also uses its data to inform supply chain decisions to make better products at scale.

Today, True&Co. has gathered over 130M data points about women through its data collection infrastructure[8][9]. These data create significant competitive advantage for True&Co. as the company continually develops ever-deeper understanding of a woman’s “emotional fit” (e.g., what style does she think fits her body best?) and her individual value/quality tradeoff.

True&Co.’s virtuous cycle of data begins with its proprietary Fit Quiz, extends to “individual merchandising”, and loops back with constant iteration and algorithm improvement based on customer feedback. Customers pick and receive five bras to try, keeping (and paying for) only the ones they want – but they are asked to provide feedback on all the bras as part of the process. This feedback data is so valuable to True&Co. that the company once charged customers $20 if they failed to provide feedback on their purchases[10]. Lam says that some customers “write essays on why a bra didn’t work.”[11] Ultimate goal? Build an “Amazon.com-like recommendation engine so that future recommendations can be better.”[12]

Looking Ahead

Larger lingerie companies like Victoria’s Secret and Maidenform have begun to use data more thoughtfully around customer fit and preferences, but True&Co. was one of the first online retailers to use an individual’s self-assessment to inform highly tailored design and decisions on product mix. On March 16th, True&Co. was acquired by PVH[13] (the owner of Calvin Klein brand), largely for its analytics tools and customer fit database, which PVH hopes can be replicated across other brands in its global portfolio.

[3] 500 Startups YouTube channel

Great post, Libby. Curious to get your take on whether entering this space via bras was the right strategic move (vs. some other apparel item). Wondering if there are other players that have tried this model elsewhere and have failed because they chose a different category.

Good question. I think bras were an interesting place to start because nobody is really “reinventing” intimate apparel in the same way that nobody was trying to fix the old-school mattress business (enter Casper). This wouldn’t work anywhere where customers will not reward you for exceeding their expectations; seems like today, people are willing to settle for “just ok” intimate apparel but will shell out for really well-fitting items. Don’t think this works uniformly across all categories, though.

I’m just happy to see innovation in this space, finally. I do believe that retail is moving towards a hyper-personalization space made possible by perfect fit scans and 3D printing. It’s a shame to me that it took so long for this sort of innovation to come to the lingerie space and I wonder how long it will take for it to become mainstream. I, for one, will be waiting.

Nice post Libby. I especially like that True & Co designed the process for customers to try out different products and then feedback size information to the firm’s database – a win-win move! I guess another future use case/ expansion of True & Co’s data and analytics strategy could be tailor making bras and other apparel pieces for customers who are willing to pay more.

Exactly. Think they could “own” fit online, which is really valuable

Very interesting approach! I took their survey and at the end felt like I could have easily picked out the same bras / sizes on the site without insights from their recommendation engine. Several of the bras they recommended were only available in 4 sizes (XS – L). I wonder if in the future they will find a scalable way to offer more customized offerings. Additionally, I wonder if they could figure out a way to gather all of the info in the questionaire through a photo – for example (privacy concerns aside) could customers upload a photo of themselves with a particular bra, and using that the company could get precise measurements vs. self-reporting. (That data could then be useful for the development of products beyond intimate apparel)

Libby – thanks for the post. I also took the quiz and received a notice that the size they recommend I purchase was not supported by the True&Co at this time and yet was still presented with 3 bras they thought would be “perfect for me” – I am fairly confused about what the size is that they are labeling me as and why I would still get recommendations if I can’t purchase anything on the site.

I also wanted to hear your thoughts on whether you think True&Co’s questionnaire has actually helped women find better fitting/suitable bras? On a few occasions I have noticed that based on how clothing is falling on a woman, she is wearing a bra that is clearly not the right size/shape for her body. However I am not always convinced that the woman knows she is wearing the wrong bra size. Does True&Co believe that their questions are in investigative enough to get the woman to unknowingly identify that her bra is not the right size? Has there been any research on how many women they believe they have helped to find the right fit? And given that Victoria Secret and other B&M Retailers measure sizes in stores, do you think there is a higher likelihood for VS to be successful in this space over an online retailer measuring you based on your current bra experience?

Thanks for your thoughts!

Anecdotally I’ve heard that people have found their “new favorite bra” through True&Co. and Third Love – though to be totally transparent, I have not shopped at either site myself. I think the closer we can get to smarter, more personalized fit, the better off we’ll be.

As you say, my research indicated that many women are indeed wearing the wrong bra size; a lot of this has to do with inconsistency in the market among fit models and spec sizing coupled with a lack of precision in measurement. True&Co. has enough information in its database at this point to make an argument that they are even more precise than an in-person measurement – and certainly less embarrassing / invasive – because they take into account a number of factors beyond cup size and band size (e.g., shape, comfort of current bra). They also ask about brands you currently wear and how those brands fit – this is important because it helps them understand the market landscape in terms of fit.

I think your point is right that there are other retailers doing in-store measurement that probably have the resources to build data sets like True&Co.’s and might be able to just replicate this – and do it better. Will be interesting to see what PVH does with True&Co.’s data and if they can do the same thing across one or more of their brands.