American Express : Using data analytics to redefine traditional banking

American Express, is harnessing the power of its data to migrate many traditional processes from legacy mainframes to Big Data processing environments, resulting in dramatic improvements in speed and performance.

With a database of over a 100 million credit cards globally, that account for over $1 trillion in charge volume every year, American Express deals with vast quantities of data. In 2010, American Express decided to leverage big data to take advantage of this huge proprietary asset to deliver innovative products in the payments and commerce space that provide value to customers.

Amex follows a closed loop system as compared to Visa and Master Card wherein it issues its own cards through its banking subsidiaries, acting as both the issuer and acquirer. Its revenue model is spend-centric targeting affluent customers rather than on transaction volumes which explains the average AmEx purchase of $150, vis-a-vis the average Visa transaction of $50.

Value Creation & Capture: Taking advantage of its Existing capabilities

The benefit of the “closed loop” is that AmEx can view all transactions on both customer and merchant side, in real time, whereas Visa and MasterCard have limited access to customer data because the contracting banks are reluctant to share information. This gives AmEx a strong competitive advantage and provides some of the key components for a new digital structure. American Express’ Risk & Information Management team in partnership with the company’s Technology group embarked on a journey to build world-class Big Data capabilities. AmEx is thus, able to analyze trends and information on cardholder spending and build algorithms to provide customized offers to attract and retain customers and leverage this information to maintain relationships with merchants using targeted marketing to match merchants with the right customers, who are likely to spend more and stay loyal.

With access to big data, machine learning models can produce superior discrimination and thus better understand customer behavior. Through sophisticated predictive models the company has been able to analyze historical transactions and 115 variables to forecast potential churn. The company believes it can now identify 24% of Australian accounts that will close within the next four months which helps it take marketing measures to retain these customers.

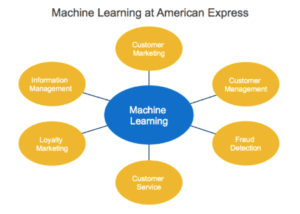

Amex has employed machine learning methods to three broad areas as mentioned below:

Fraud Detection: To detect fraudulent transactions quickly so as to minimize loss, the company employed a machine learning model that uses various inputs like card membership information, spending details, and merchant information which are pattern-matched against evolving algorithms in real time to flag transactions that have a high probability of being fraudulent. This has added a precision of milliseconds to the system’s predictive capabilities. According to estimates by the company, the approach has identified $2 billion in potential annual incremental fraud incidents, which the company was able to sort out before any money was lost.

New Customer Acquisition: The use of web and targeted marketing through machine learning models, has resulted in a 40% rise in new customer acquisition via online interactions as opposed to 90% of new customers that were acquired through direct mail campaigns reducing costs.

Improved Customer/Merchant Experience: American Express is increasingly moving away from the traditional function of providing credit to consumers and merchant services for processing transactions, towards establishing connection between consumers and the merchants on personalized offers, reducing a three-day process to 20 minutes on their Big Data platform. Within two years of its launch in 2010, the Amex Offers program saved card holders a combined $100 million.

The company is using its vast data flows to develop apps that can connect a cardholder with products or services. One app looks at past purchase data and recommends restaurants in the area that the user is likely to enjoy. Its app, Amex Offers, shows real time coupons relevant to a cardholder’s lifestyle and buying habits based on the cardholder’s physical location near the businesses that offer them. Apart from benefitting cardholders it also has the potential to incentivize more businesses to accept American Express. It has partnered with Uber and Airbnb allowing its members to use their AmEx loyalty rewards on these platforms. In 2015, it launched AmEx Express Checkout, which allows members a streamlined way to make all kinds of online purchases.

On the merchant side, American Express has moved from quarterly reports to online business trend analysis and industry peer benchmarking based on anonymous data that is delivered continuously to help merchants figure out how they are doing compared to the competition.

Challenges & Opportunities: The need to create a comprehensive Digital Strategy

The ongoing challenge that the company faces is balancing big data investment between immediate needs and research that will drive the next generation of capabilities. Also, for AmEx there were privacy and regulatory challenges which governed which data could be used.

Going forwards, the challenge for AmEx is to avoid using its data advantage solely to drive traditional marketing, and aim for more than an increase in consumer spending. Its competition now is with the Fintech startups that are changing the way payments are made. It should work towards creating an AmEx internet platform to integrate all their services, while driving internal efficiencies and cost reductions. Realizing this AmEx has increased its social media engagement. It has also introduced a prepaid payment card Serve, supporting peer-to-peer payments and a Facebook app to pay friends directly from the FB wall. With its outstanding track-record in security and personalized transactions AmEx has built an enviable brand value which it can leverage as it undertakes a digital transformation.

Sources:

https://www.enterprisetech.com/2014/10/17/hadoop-new-backbone-american-express/

https://www.rtinsights.com/american-express-recommendation-engine/

https://assets.cdn.sap.com/sapcom/docs/2015/09/b4b02510-437c-0010-82c7-eda71af511fa.pdf

https://www.forbes.com/sites/ciocentral/2016/04/27/inside-american-express-big-data-journey/#9893afd3d89b

http://www.cmo.com.au/article/560678/how-amex-using-data-creative-tap-into-customer-contexts/

https://www.forbes.com/sites/greatspeculations/2014/03/13/how-american-express-gains-a-competitive-advantage-from-its-closed-loop-network

Great blog post!

I am wondering what the market share of AmEx customers is for important merchants = Is it large enough for them to bother to leverage the data information “using targeted marketing to match merchants with the right customers”?

Do you think that Visa and MasterCard can convince banks somehow to enter anonymized data sharing agreements in order to share benefits from data analytics?